Advertisement|Remove ads.

ASML Stock Plunges After Leaked Earnings Reveal Forecast Cut, Fuel Investor Concerns

Shares of ASML Holding NV (ASML) tanked over 17% on Tuesday after the microchip-equipment maker’s third-quarter earnings were released earlier than expected and revealed lowered forecasts for the year.

ASML’s earnings results showed that the company now expects its net sales for 2025 to be between €30 billion and €35 billion (approximately $32.72 billion to $38.16 billion). This new forecast falls within the lower half of the sales range the company had previously predicted, suggesting more conservative expectations for revenue growth in the coming quarter.

ASML said that while demand for AI-related chips was strong, other parts of the semiconductor market were “taking longer to recover.”

The quarterly earnings numbers were published on the company’s website a day earlier than expected “due to a technical error.”

ASML beat Wall Street revenue expectations of $7.82 billion to deliver a solid $8.14 billion, which is a 11.2% increase over the same quarter last year. CEO Christophe Fouquet also pointed out that net sales for the quarter were above guidance in a transcript of a video, also released a day early, “driven by more DUV [deep ultraviolet machines]”

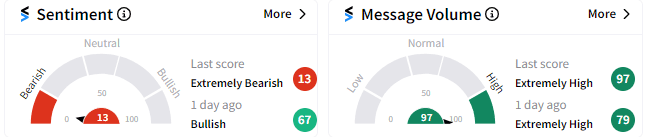

The lowered forecast has clearly disappointed investors, with retail sentiment on Stocktwits flipping to ‘extremely bearish’ (13/100) from ‘bullish’ just a day ago with users speculating whether ASML will be able to make a comeback anytime soon.

Europe’s biggest tech firm is the largest supplier of equipment used to manufacture chips, with top customers including AI chipmaker Taiwan Semiconductor Manufacturing Company (TSM), Intel (INTC), Samsung, Micron Technology (MU), and SK Hynix.

Following the news, shares of Intel and TSMC dipped over 2% on Tuesday afternoon, while those of Micron Technology fell 3%.

According to ASML, the lag in other parts of the AI market includes companies that make logic chips delaying orders, which has prompted memory chip manufacturers to add only “limited” new capacity.

The news also seems to have piled more pressure on chipmakers like Nvidia Corp (NVDA), Advanced Micro Devices Inc (AMD), and Broadcom Inc (AVGO), all trading down by at least 4%, after news surfaced that U.S. officials may impose restrictions on AI chip exports to certain nations.

ASML’s stock closed over 15% lower in Europe, the biggest single day drop for the company since June 1998, according to Reuters.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)