Advertisement|Remove ads.

Adani Power: Technicals Signal More Upside, SEBI RA Suggests Cautious Accumulation

Adani Power is displaying bullish signals, supported by a strong technical setup. The stock is currently trading at ₹601, having gained nearly 9% in the past month.

Adani Power shares are trading above their 14-day, 55-day, and 200-day exponential moving averages (EMAs), indicating a firm and positive price structure, according to SEBI-registered analyst Deepak Pal.

Supporting this bullish view, the Parabolic SAR indicator shows dots positioned below the price, confirming the ongoing upward trend, he added. The moving average convergence/divergence (MACD) indicator also signals strength, with the MACD line staying above the signal line, indicating active buying interest.

Additionally, the Relative Strength Index (RSI) is hovering around 64, suggesting that bullish momentum remains intact, with a potential for further upside, Pal said.

Given these favorable technical indicators, Adani Power could be considered for accumulation using a ‘buy on dips’ approach, the analyst recommended. Fresh positions could be accumulated in the ₹570–₹575 range, with a stop-loss at ₹550, Pal said.

If the current momentum continues, Adani Power stock may soon test higher resistance levels around ₹640–₹650 in the near term, representing an 8% upside from the current trading price.

Overall, Adani Power boasts strong fundamentals with a healthy 40% ROE, and rising institutional interest. Its promoter holding stands at 74.97%. While its D/E ratio is at 1.10, the company generates strong cash flows and is actively reducing its debt, Pal said.

Despite its long-term growth potential, the stock has already seen a sharp rally, so new investors should consider entering on corrections to manage short-term risks, he added.

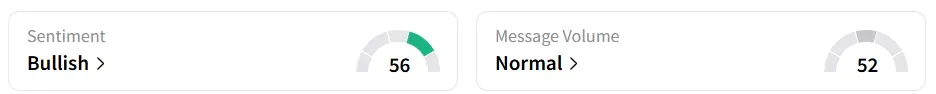

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

Year-to-date (YTD), Adani Power shares have climbed 14.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)