Advertisement|Remove ads.

Aehr Test Systems’ New AI Chip Orders Spark Investor Buzz: Retail Chatter Explodes Over 490% In 24 Hours

Aehr Test Systems Inc. (AEHR), a provider of semiconductor test and burn-in equipment, experienced a 494% surge in Stocktwits user messages in the last 24 hours after the company secured new orders for its advanced Sonoma ultra-high-power systems.

The purchase comes from a leading hyperscaler focused on volume production testing and burn-in of AI processors, said the company on Tuesday.

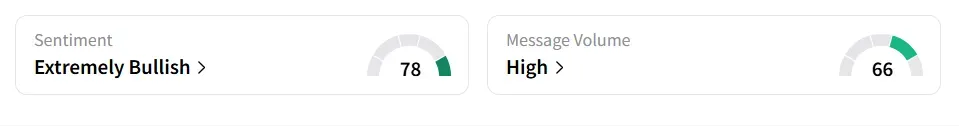

Aehr Test Systems stock traded over 8% higher on Wednesday afternoon. Retail sentiment toward the stock improved to ‘extremely bullish’ (78/100) from ‘bullish’ territory the previous day amid ‘high’ message volume levels.

A bullish Stocktwits user expressed optimism on the latest development.

Another user highlighted AEHR's ability to prove the efficacy of their products to potential new customers.

The follow-on orders involve eight Sonoma units to be delivered over six months from Aehr’s Fremont, California, production center.

The Sonoma units use turnkey Burn-in Modules (BIMs) with liquid-cooled temperature controls. Each BIM incorporates a custom PCB (Printed Circuit Board), socket contactor, liquid thermal assembly, and purpose-built test programs.

They support up to 2,000 W per device, enabling high-current delivery, dynamic stress testing, and real-time output monitoring at elevated temperatures.

“Aehr enables customers to perform their production burn-in screening, qualification, and reliability characterization in package form for GPUs, AI processors, CPUs, and network processors,” said President and CEO Gayn Erickson

As demand for AI chips surges, hyperscalers seek highly efficient test and burn-in platforms. Aehr’s Sonoma systems, with their advanced thermal, power, and automation features, look to cater directly to this growing industry need.

Aehr Test Systems' stock has gained over 32% year-to-date and more than 22% in the last 12 months.

Also See: Can Opendoor Stay In The Meme Stock Race? Retail Still Wants To Load Up On The Shares

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)