Advertisement|Remove ads.

Affimed Receives Nasdaq Deficiency Notice Over Low Share Price: Retail’s In Wait-And-Wait Mode

Shares of Affimed N.V. (AFMD) were in the spotlight on Monday morning after the company received a notice from Nasdaq indicating a compliance issue with its stock price.

Affirmed said that the Nasdaq notice indicated the bid price for the company’s common shares had closed below the minimum $1.00 per share requirement for continued listing on the bourse.

Affirmed, headquartered in Mannheim, Germany, stated that it has been granted an initial period of 180 calendar days, or until October 13, 2025, to regain compliance.

The company said that if it fails to regain compliance with the Minimum Bid Price Rule during the period, it may consider applying to transfer its securities from The Nasdaq Global Select Market to The Nasdaq Capital Market, provided that it meets the requirements.

Affirmed also added that there is no assurance that Nasdaq would grant the company’s request for continued listing in the case.

In the meantime, the firm intends to monitor the bid price of its common shares and consider available options to regain compliance with the Minimum Bid Price Rule.

Affimed is a clinical-stage company aimed at developing treatments for cancer. In December, the company announced positive updates from a trial of its AFM24 in combination with atezolizumab in Non-Small Cell Lung Cancer patients.

AFM24 is an innate cell engager molecule that activates the innate immune system to kill cancer cells.

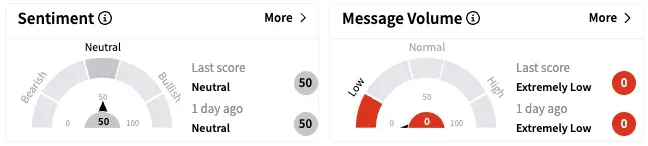

On Stocktwits, retail sentiment regarding Affimed remained unchanged within ‘neutral’ territory over the past 24 hours, while message volume remained at ‘extremely low’ levels.

AFMD stock is down by about 46% so far this year and by over 85% over the past 12 months.

Also See: DHL Freezes Shipments Worth Over $800 To US Consumers Amid Rising Trade Tensions

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_merck_logo_resized_05f46cfc54.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)