Advertisement. Remove ads.

Affirm Holdings Stock Soars Over Upbeat Q4, Strong Guidance: Retail Investors Remain ‘Bullish’

Affirm Holdings (AFRM) shares rose nearly 22% in Thursday’s pre-market after the firm, which provides point-of-sale installment loans for shopping, reported an upbeat set of fourth-quarter results and provided strong guidance.

The company reported an adjusted loss of $0.14 compared to an analyst estimate of $0.51. Revenue grew 48% year-over-year (YoY) to $659 million versus an estimate of $604 million. Affirm’s net loss narrowed to $45.14 million from $205.96 million in the year-ago period.

Affirm reported a 31% YoY rise in its gross merchandise value (GMV) — the total value of transactions — to $7.2 billion. CEO Max Levchin said the firm expects to be profitable on a GAAP basis in the fourth fiscal quarter, and plans to operate the business while maintaining GAAP profitability thereafter.

The firm’s operating loss came in at $73 million versus $244 million a year earlier, helped by a $43 million YoY reduction in other operating expenses, which the company partly attributed to a restructuring program announced in February 2023 and the realization of several operational efficiency efforts.

The largest decline was seen in technology and data analytics expenses, which fell $28 million YoY, it said.

The company expects current-quarter GMV in the range of $7.1 billion to $7.4 billion. The firm expects to report revenue of $640 million to $670 million, higher than Wall Street’s estimate of $625 million.

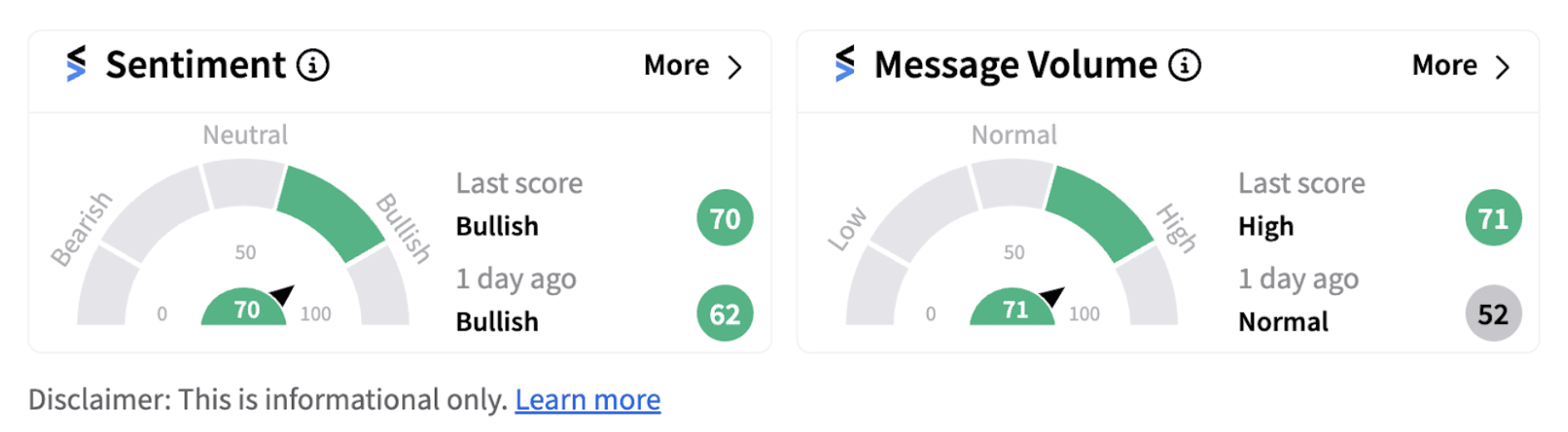

Following the announcement, retail sentiment on Stocktwits continued to trend in the ‘bullish’ territory (70/100), with a higher score and accompanied by ‘high’ message volume.

Federal Reserve Chairman Jerome Powell said recently that time has come to adjust the policy rate. The widely anticipated commencement of a rate cut cycle in September is expected to aid Affirm Holdings bring down its cost of funds and improve margins.

Shares of the firm have lost over 32% since the beginning of the year and are down over 87% since its highs in Nov. 2021. Despite a decent rebound in August, the stock still trades below its 200-day moving average. Investors are cheering the latest earnings beat but will be watching out if the firm uses the potential rate cuts to its advantage in the coming times.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_new_b2128e67d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228236200_jpg_4e01019dfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_abbvie_logo_resized_2b8fc4a175.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Uber_July_8874a038f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)