Advertisement|Remove ads.

Airbus CEO Reportedly Admits Potential Defeat In Chase For Orders As Boeing Outpaces Rival For First Time In 6 Years

- Airbus CEO Guillaume Faury stated that U.S. President Donald Trump’s trade negotiations have helped the planemaker’s U.S. rival.

- The surge in demand for Boeing jets comes as Airbus has struggled with industrial glitches and fuselage panel quality issues in recent times, leading to the company's largest recall in history.

- Airbus still leads Boeing in overall backlog and deliveries; in November, Boeing delivered 44 jets, compared with 72 for Airbus.

Airbus CEO Guillaume Faury reportedly said the planemaker might lose out to Boeing in aircraft orders for the first time in six years.

According to a Reuters News report, citing Faury’s interview with the French radio station, the Airbus Chief conceded a potential defeat a day after Boeing’s total tally surged to 1,000 for the year, more than double the 11-month total for 2024, which came in at 427.

What Did Faury Say?

Faury reportedly told the radio station France Inter that the fact that the company has been ahead on orders for five years means its order backlog is much higher than that of its main competitor.

"But it is true that they have been helped by the American President as part of tariff negotiations with several countries, where plane orders became part of the resolution of trade disputes," he said.

Boeing has nabbed several orders this year as countries around the world sought to cut their trade deficits with the U.S. Airplanes, due to their high prices, offer an efficient way to do so. The surge in demand for Boeing jets comes as Airbus has struggled with industrial glitches and fuselage panel quality issues, leading to the company's largest recall in history.

Industry leaders are expressing greater confidence in Boeing than in Airbus. IATA director general Willie Walsh told Reuters earlier this week that people trust Boeing’s delivery commitment much more than Airbus's.

Airbus will need to deliver 133 jets this month to meet its annual 2025 delivery target of 790, according to the company. However, Airbus still leads Boeing in overall backlog and deliveries. In November, Boeing delivered 44 jets, compared with 72 for Airbus.

Boeing Turnaround

The planemaker had its own fair share of trouble in recent times. Boeing stock fell 6% in November, logging its third straight monthly decline. The recent declines followed the company's third-quarter loss, which was partly due to delays in deliveries of its large-body 777X aircraft. The firm booked a $4.9 billion pre-tax charge due to the delay and now expects to bring its 777X aircraft to customers in 2027.

However, Boeing aims to increase deliveries of its best-selling 737 Max jets and widebody aircraft next year. It is projected to post positive annual cash flow for the first time since 2023 next year.

What Are Stocktwits Users Thinking?

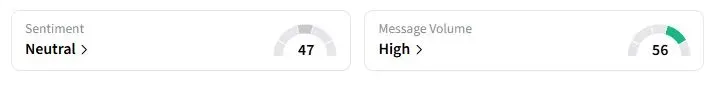

Retail sentiment on Stocktwits about Boeing was in the ‘neutral’ territory at the time of writing.

Boeing stock has risen by more than 12% this year.

Also See: What Is The Federal Open Market Committee And Why Is It Important?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)