Advertisement|Remove ads.

Alaska Air Stock Rises After Upbeat Q3 Earnings: But Retail’s Unconvinced

Shares of Alaska Air Group, Inc ($ALK) rose over 5% on Thursday after the firm reported upbeat third-quarter earnings.

Revenue rose 8% year-over-year (YoY) to $3.07 billion, compared to a Wall Street estimate of $3 billion.

Alaska Air said that managed corporate revenue grew 9% YoY with double-digit growth from the technology and professional services industries. At the same time, Premium revenue performance also remained strong this quarter, with first and premium class revenue rising 10% and 8% YoY, respectively on 5% year-over-year growth in premium seat capacity.

Earnings per share (EPS) came in at $2.25 versus an estimate of $2.22. Net income rose nearly 70% YoY to $236 million during the quarter. The airline clarified that its consolidated report includes 13 days of Hawaiian Airlines results.

CCO Andrew Harrison said the company is investing in commercial engines to compete more effectively with the larger carriers, increase loyalty among our guests and realize synergies from both the commercial and cargo businesses.

“These investments include re-imagined lounge and onboard offerings designed to meet the needs of our most loyal guests, optimized route networks that get people to more places in less time, a seamless booking to boarding experience, and more,” he said.

Alaska Air said that one-third of its second half 2024 unit cost increases on a YoY basis are directly related to relative overstaffing and the natural pressure that lower capacity puts on fixed cost base.

“We expect this pressure to be transitory and to return to optimized resource levels relative to our capacity throughout 2025. Despite this, productivity for the quarter improved 4.6% year-over-year,” the company said.

For the fourth quarter, the company expects its capacity to increase 1.5% to 2.5% and EPS at $0.20 to $0.40.

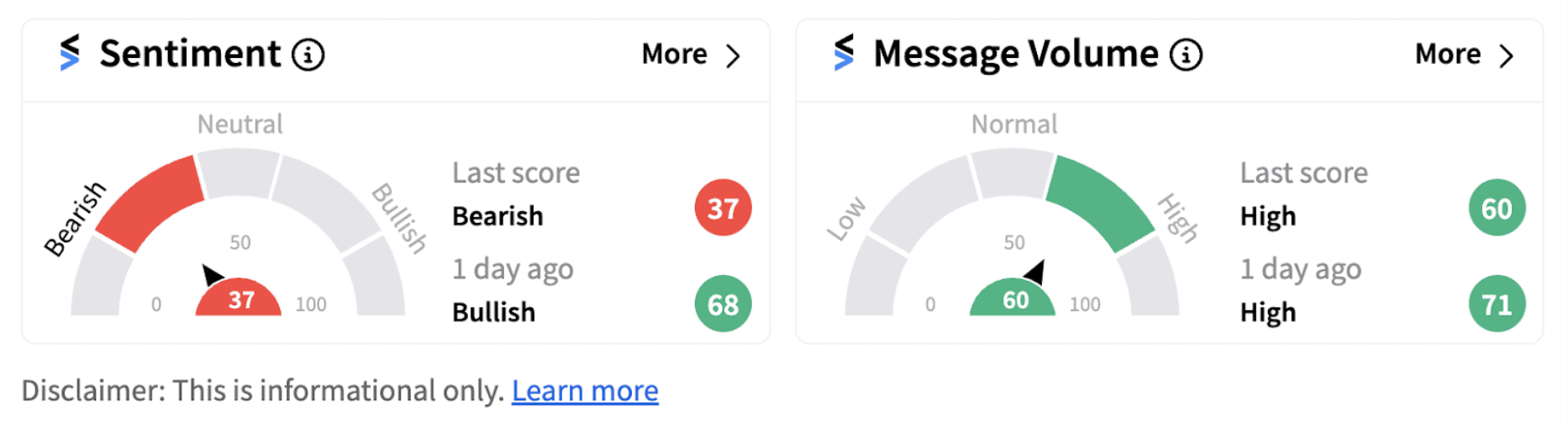

Despite the upbeat results, retail sentiment on Stocktwits dipped into the ‘bearish’ territory (37/100) from ‘bullish’ a day ago.

Alaska Air shares have gained nearly 30% since the beginning of the year.

Also See: Mastercard Stock In Retail Spotlight After Upbeat Q3 Earnings: Retail Sentiment Spikes

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)