Advertisement|Remove ads.

Alibaba Earnings: Q2 Results Miss Estimates But Retail Believes Firm’s Generating Good Cash In Tough Environment

Shares of Chinese e-commerce and technology giant Alibaba Group Holding (BABA) fell over 3.5% in Thursday’s pre-market trading after the firm’s second quarter results missed analyst estimates.

Alibaba reported a 4% year-over-year (YoY) rise in revenue at 243.24 billion RMB or $33.47 billion versus an estimate of $34.66 billion. Net income declined 27% YoY to 24.27 billion RMB compared to an expected 26.91 billion RMB.

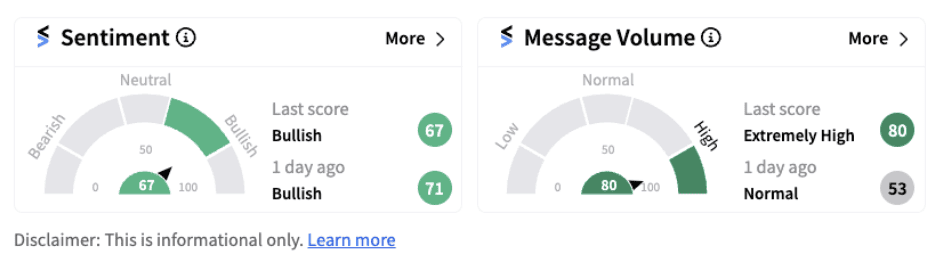

Following the announcement, retail sentiment remained in the ‘bullish’ territory (67/100), albeit at a slightly lower score from a day ago, amid message volume hitting a year’s high.

Alibaba has been working hard on a turnaround with new chief executive Eddie Wu trying to revive both the firm’s e-commerce and cloud businesses.

The firm’s Taobao and Tmall Group recorded a 1% YoY decline in revenue to $15.60 billion while Cloud Intelligence Group managed a 6% YoY rise in revenue to $3.65 billion. With increasing competition from PDD Holdings, investors are concerned whether the tussle to retain market share would lead to a decline in the firm’s margins.

Notably, Alibaba’s operating margin fell to 15% in the second quarter from 18% in the year-ago period. The company attributed the drop in margins mainly to reversing a RMB6.90 billion share-based compensation expense in the quarter ending June 30, 2023, related to mark-to-market adjustment of Ant Group’s employee stock awards.

Alibaba repurchased a total of 613 million ordinary shares for a total of $5.80 billion during the quarter.

Bullish Stocktwits followers of Alibaba believe the firm is generating decent cash even in a tough economic environment and that share repurchases are expected to continue.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)