Advertisement|Remove ads.

Allegro Microsystems Stock Slides Premarket After Board Snub Prompts On Semi To Withdraw Buyout Offer : Retail Optimism Tempers

Allegro Microsystems, Inc. (ALGM) stock fell sharply in Tuesday’s premarket session after On Semiconductor Corp. (ON) terminated its buyout offer for the former.

The decision comes a little over a month after On Semi announced its proposal to buy Allegro Microsystems for $35.10 in cash, with the offer price translating to an implied enterprise value of $6.9 billion.

The per-share offer price represented a 31% premium to the $26.78 level at which the target company’s stock was trading before the interest was made public.

Although Allegro Microsystems, a provider of power and sensing solutions for motion control and energy-efficient systems, acknowledged the receipt of the proposal, it did not issue any further update on it.

On Semi is a fabless semiconductor company that provides intelligent technology to automotive and industrial end markets.

In a statement released Monday after the market closed, On Semi said it has determined that there was no “actionable path forward.”

On Semi said it will now focus on other existing opportunities to enhance stockholder value, adding that it will allocate capital towards its existing share repurchase program.

Hassane El-Khoury, CEO of On Semi, said. “While we continue to believe that a combination with On Semi would be beneficial to all stakeholders of both companies, after careful consideration, we have decided to withdraw our acquisition proposal given the reluctance of Allegro’s Board of Directors to fully engage and explore our proposal.”

“With market-leading technology, a robust innovation pipeline, and a clear strategic roadmap, we continue to see significant long-term opportunities in our core markets of automotive, industrial, and AI data centers.”

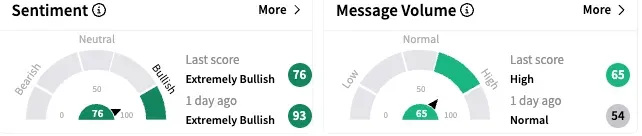

On Stocktwits, retail sentiment toward Allegro Microsystems stock stayed extremely bullish’ (76/100) early Tuesday, although the degree of optimism tempered from a day ago. The message volume perked up to ‘high levels.’

A retail watcher questioned the logic behind Allegro Microsystems’ rejection of the buyout bid.

On the other hand, sentiment toward On Semi stock was ‘extremely bullish’ (81/100) and the message volume stayed high.

Allegro Microsystems is up marginally this year, while On Semi shares have lost over 43%. In Tuesday’s early premarket session, the former slumped over 12% to $19.29, while the latter gained about 0.50% to $35.79.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Retail Traders Flock To FatPipe As Shares Leap 28% Days After Market Debut

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_joblessclaims_resized_jpg_b395b1ff15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cme_resized_5dbde36693.jpg)