Advertisement|Remove ads.

Alphabet’s Cloud And YouTube Strength Draws Tigress Financial’s Praise: Retail Says Stock ‘Immune To Any Slowdown’

Alphabet Inc. (GOOG, GOOGL) just received a fresh vote of confidence from Tigress Financial, as analyst Ivan Feinseth boosted the firm’s price target to $280 from $240, while reiterating a ‘Strong Buy’ rating.

Feinseth attributes the revision to the company’s accelerating momentum in artificial intelligence, cloud computing, and its digital video platform, YouTube, as per TheFly.

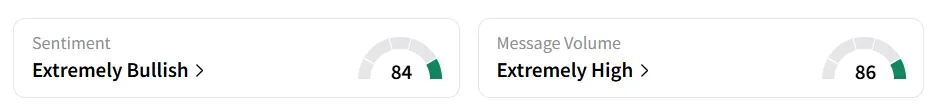

Alphabet stock inched 0.1% lower on Friday mid-morning. On Stocktwits, retail sentiment around the stock stayed in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock saw a 98% increase in user message count in the last 7 days. A bullish Stocktwits user said the stock is ‘immune to any slowdown’.

Another user batted for $3 trillion valuation.

According to the analyst, the stock’s recent rally to all-time highs is driven by investor enthusiasm over Alphabet’s strong position in next-generation technology. The firm emphasized that the company’s influence touches nearly every major transformative trend in the technology space, reflecting its relevance as demand increases.

In the second quarter (Q2), Google Cloud revenue jumped 31.7% year-on-year (YoY) to $13.62 billion, helped by growth across core Google Cloud Platform (GCP) products, artificial intelligence (AI) infrastructure, and generative AI (GenAI) products.

Additionally, the tech giant has increased its capital expenditure (capex) budget for 2025 to approximately $85 billion, up from the previously announced $75 billion. On Tuesday, a federal court judge ruled that the company won’t have to separate its Chrome browser and Android mobile platform.

Alphabet stock has gained over 23% year-to-date and over 48% in the last 12 months.

Also See: Qualcomm Sparks Retail Interest As Snapdragon Ride Pilot System Debuts In BMW iX3

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)