Advertisement|Remove ads.

Alphabet: The ‘Best AI’ Play Right Now? Retail Bulls Hype Up GOOGL As Shares Push For A Clean Break Above $300

- Warren Buffett’s Berkshire Hathaway recently added $4.34 billion worth of Google shares to its portfolio.

- Gemini's share of generative AI (GenAI) web traffic has risen to 13.7% from 5.6% 12 months ago.

- The Google Cloud Platform is among the top three public cloud vendors globally.

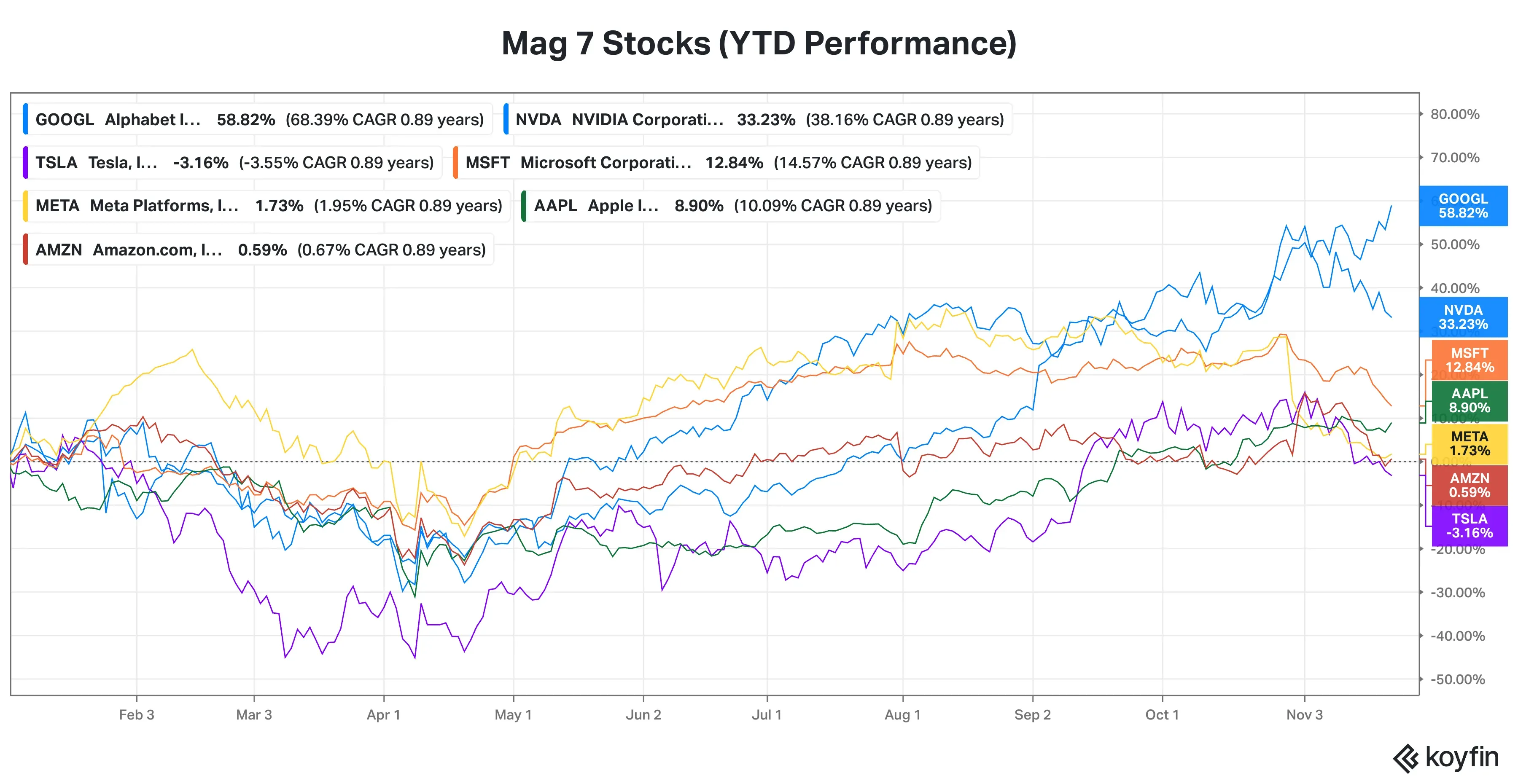

Alphabet Inc. (GOOGL, GOOG), which spent most of the year in the red until late July, has since staged a solid recovery. The stock has climbed steadily, with November’s tech-driven sell-off doing little to slow its momentum.

In what is seen as a major vote of confidence in Alphabet, billionaire investor Warren Buffett’s Berkshire Hathaway recently added $4.34 billion worth of Google shares to its portfolio.

For the year-to-date period, Alphabet stock has gained 59%, making it the best-performing “Magnificent Seven” stock.

Source: Koyfin

Here’s a dive into the factors that imparted resilience and buoyancy.

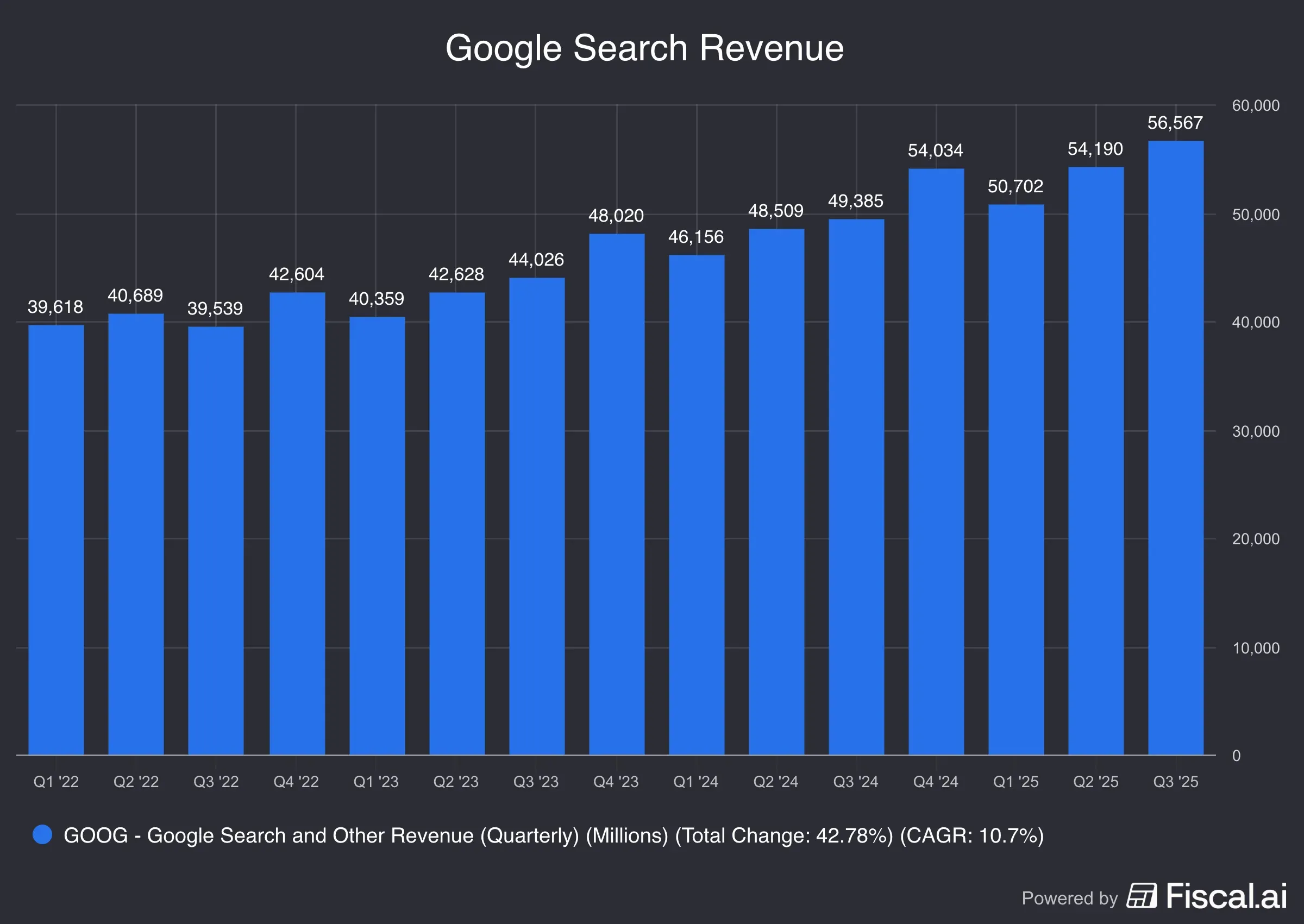

Google Search Keeps Growing

Revenue from Google Search & Other, which accounted for roughly 55% of the September quarter’s revenue, grew by about 15% year over year (YoY). The segment’s revenue has held up reasonably well despite the doomsday theory of its demise at the hands of artificial intelligence (AI).

Source: Fiscal.ai

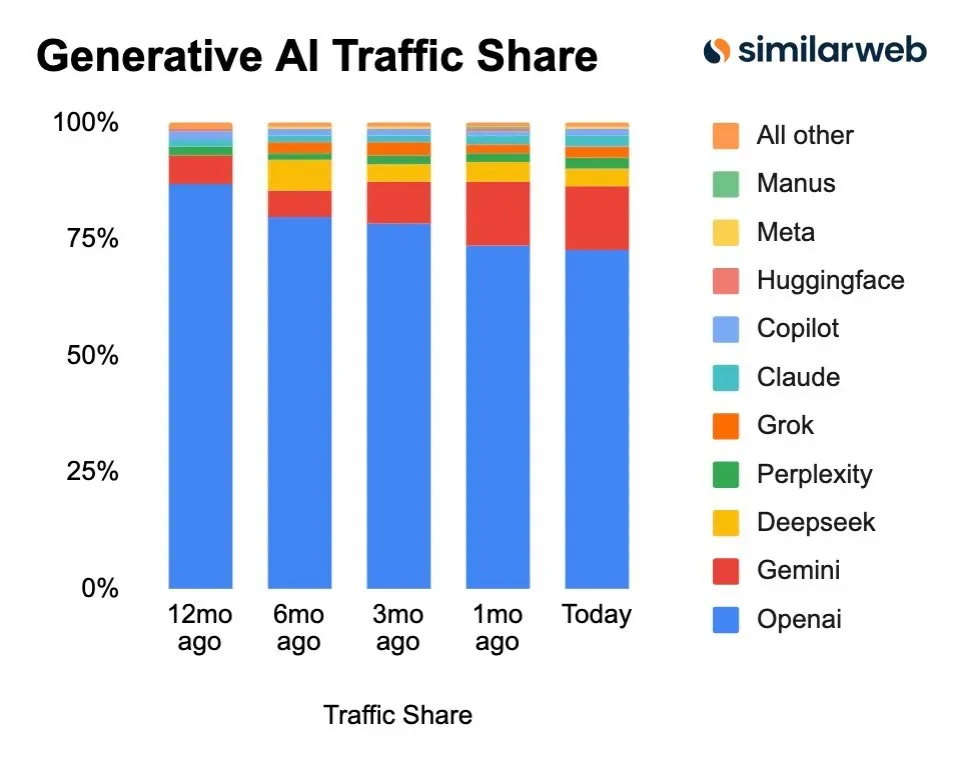

Gemini's Meaningful Inroads

Even as AI models mushroom, Alphabet’s Google has sizably increased its market share. According to a chart shared by Similarweb, Gemini's share of generative AI (GenAI) web traffic has risen to 13.7% from 5.6% 12 months ago, eating away at the market share of leader OpenAI’s ChatGPT.

Source: Similarweb X post

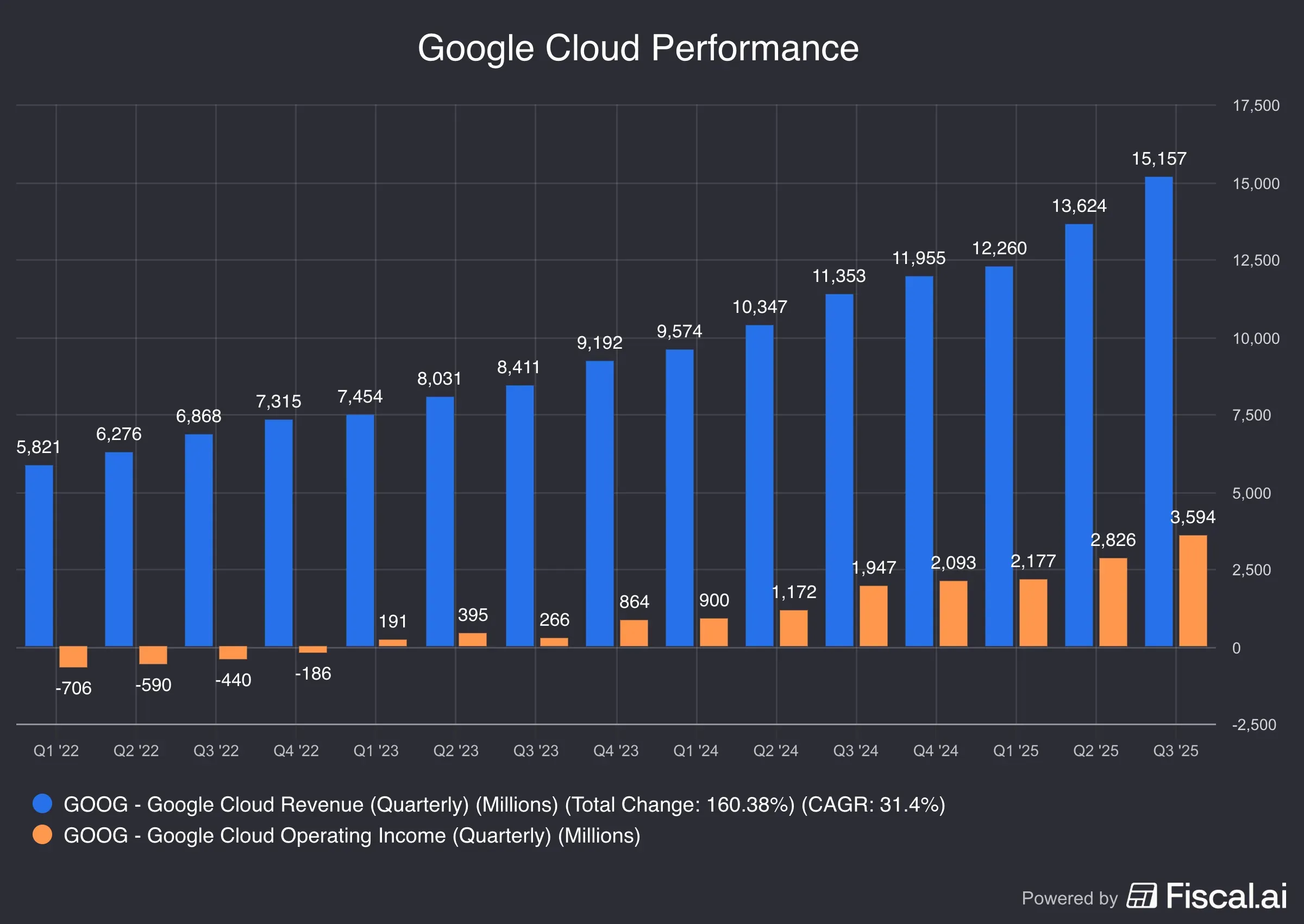

Thriving Google Cloud Business

The Google Cloud Platform is among the top three public cloud vendors globally. According to Synergy Research Group, Amazon’s AWS held 29% of the cloud market in the third quarter, followed by Microsoft’s Azure (20%) and Google Cloud (13%). In the third quarter, Google Cloud revenue jumped 34% YoY, a faster pace than Microsoft’s 33% and Amazon’s 20%.

Source: Fiscal.ai

Other Flywheels

Google also has a thriving quantum computing business, having announced the Willow quantum computing chip and the Quantum Echoes algorithm. Its Waymo self-driving tech subsidiary is touted as a multi-trillion-dollar opportunity. On the third-quarter earnings call, CEO Sundar Pichai said, “Waymo's growth and momentum are strong, and 2026 is shaping up to be an exciting year.”

The company has developed its own AI chip, the Tensor Processing Unit (TPU), using its TensorFlow software. It began using it in-house in 2015, with the third-party sales starting in 2018.

What Retail Feels About Alphabet Stock

On Stocktwits, retail sentiment toward Alphabet stock remained ‘bullish,’ though optimism had tempered slightly from a day ago. The message volume also remained ‘high.’

A bullish user said they expected the stock to top $320 on Monday.

Another watcher shared a screenshot of a story stating that OpenAI’s Sam Altman has admitted that Google’s Gemini 3 has a temporary edge in AI.

A user called Alphabet the “best AI” company right now.

Alphabet Stock

The stock appears a little jaded after its run since late July. The 14-day relative strength index (RSI) is now perched in the overbought zone. In the eventuality of a pullback, the stock could retrace to the $290 level — the upper bound of a recent consolidation range. Back-filling a gap-up seen in late October could take it to the $275 zone.

Source: Koyfin

Source: Koyfin

On Friday, Alphabet’s stock settled at a new closing high of $299.66, while it could not breach the intraday high of $306.42. According to Koyfin, the average price target for the stock is $321.94, implying scope for 7% upside potential.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Snowflake Analysts Predict Strong H2: Is The Stock A Buy At Current Levels?

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)