Advertisement|Remove ads.

Altimmune Shares Sink This Year, But Retail Traders See A Buyout On The Horizon

Shares of Altimmune Inc. are down more than 23% this year, but that has not deterred retail investors from losing hope in the clinical-stage biotech company.

The company has gained traction for its lead candidate, pemvidutide, a GLP-1/glucagon dual receptor agonist being developed for obesity and MASH. In a mid-stage trial, the drug showed that it helped patients reduce their weight by more than 15%.

At its R&D Day last week, Altimmune provided more cheer as it unveiled plans to test pemvidutide for treating alcohol use disorder and alcohol-associated liver disease in the second and third quarters of this year.

According to The Fly, Evercore ISI said it likes Altimmune's latest expansion and suggested that pemvidutide could rake in more revenue for the new goals than MASH, as 35 million people in the U.S. alone suffer from alcohol use disorder and alcohol-associated liver disease.

The research firm added that there is some preclinical and anecdotal evidence to support its thesis.

Assuming all goes well, Altimmune will need to fund a Phase 3 program later this year in addition to the AUD/ALD studies, said Evercore, which has an Outperform rating on the shares and a price target of $25.

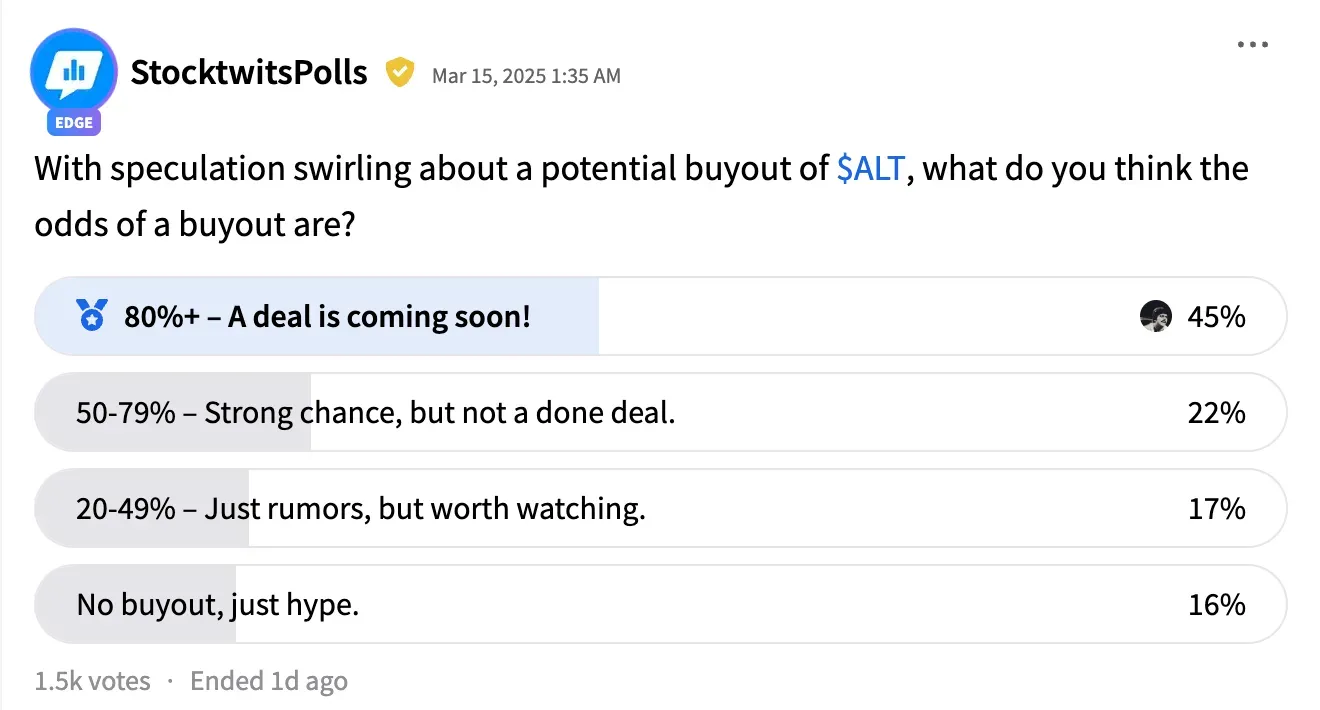

Retail investors on Stocktwits — where Altimmune has over 36,000 followers — have long speculated that the company could be a takeover target. Last year's key C-suite hire at a "pivotal time" for Altimmune bolstered their belief.

A Betaville report suggested Altimmune has begun a strategic review with an adviser, with speculation that three major pharmaceutical firms — one FTSE-100 listed, one German, and one U.S.-based — may be involved.

One bullish user said it's "not if, but when [a deal happens]. Too much TAM [total addressable market] for this pipeline of a molecule."

Another user speculated a buyout could happen "within three months," noting the stock is "heading north each week" with "higher lows, higher highs."

Altimmune's stock, which was added to the Nasdaq Biotechnology Index (NBI) in December, has a short interest of 28.2%, according to Koyfin data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)