Advertisement|Remove ads.

Retail Investors Hammer AMC Entertainment After It Discloses Preliminary Q2 Earnings: Here’s What The Firm Said

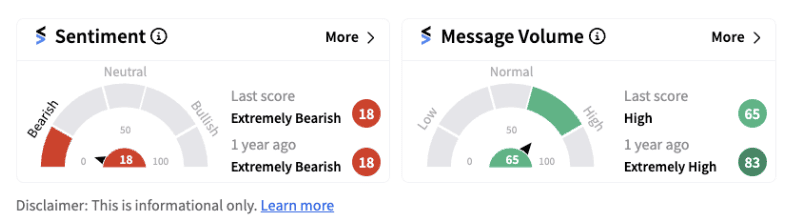

AMC Entertainment Holdings on Wednesday announced preliminary earnings for the second quarter of 2024. The company expects a 23.50% year-over-year (YoY) fall in its revenue at $1.03 billion. As for its earnings, it expected a net loss of $32.80 million (down from $8.60 million in net income a year ago). Shares of the firm fell nearly 8% following the announcement while retail sentiment continued to trend in extremely bearish territory (18/100) supported by high message volumes.

AMC has attributed the weakness to the prolonged actors’ and writers' strikes of 2023 which severely reduced the number of movies being released theatrically in the early months of 2024.

Still, Chairman and CEO Adam Aaron said the firm remains confident that industry-wide movie revenues for the second half of 2024, and into 2025 and 2026 will continue to show increasing strength. “This in turn suggests that AMC should enjoy increasing adjusted earnings before interest, tax, depreciation, and amortization (EBITDA), if and when overall industry revenues are climbing,” he said.

The firm is scheduled to report its full results for the second quarter after the market closes on August 2. Retail investors will be awaiting an update on whether the company plans to issue new equity capital to service its large debt loan, which it recently restructured by using its theaters as collateral.

The stock hasn’t had a good year so far, having lost over 23% and remaining volatile as part of a core group of “meme stocks” tied to the influence of Roaring Kitty and others. On Wall Street, Macquarie recently raised its price target on the stock from $3.50 to $4.00 while giving an “Underperform” rating suggesting an improving, but still concerning picture.

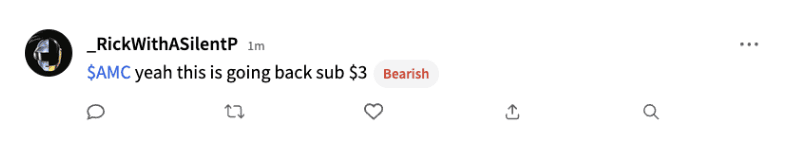

While a trading halt near the market-open allowed Stocktwits users to digest the news, many expressed concern about downside volatility ahead. Meanwhile, one user with a bearish stance on the stock is expecting it to eventually fall back below the $3 mark towards its all-time lows set in April.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)