Advertisement|Remove ads.

Ball Stock Gains Pre-Market Despite Mixed Q4 Earnings: Retail Neutral

Ball Corp.’s (BALL) stock rose nearly 2% in pre-market trading on Tuesday following a mixed fourth-quarter 2024 earnings report, on track to hit its highest level this month.

The aluminum packaging company exceeded earnings per share (EPS) expectations, reporting $0.84 compared to the estimated $0.81. However, revenue came in at $2.88 billion, slightly below the consensus estimate of $2.93 billion, according to Koyfin.

Ball reported a net loss of $32 million for the quarter.

For the full year, Ball posted earnings of $4.01 billion on sales of $11.80 billion, compared to $707 million on sales of $12.06 billion in 2023.

Comparable net earnings rose to $977 million from $920 million in the previous year.

The company's comparable net earnings were $977 million versus $920 million in 2023.

Ball’s beverage packaging segment delivered mixed regional results, with growth in EMEA offset by volume declines in North America.

The company noted that full-year and fourth-quarter sales reflected higher volumes year-over-year, partially offset by the pass-through of lower aluminum costs.

In 2024, Ball returned $1.96 billion to shareholders through share repurchases and dividends.

Ahead of its earnings, the company announced a new $4 billion share repurchase authorization, replacing all previous programs, alongside a quarterly cash dividend of $0.20 per share, payable on March 17, 2025, to shareholders of record as of March 3, 2025.

At the time, CFO Howard Yu emphasized that the increased share repurchase authorization will support their ongoing multi-year capital return strategy to shareholders.

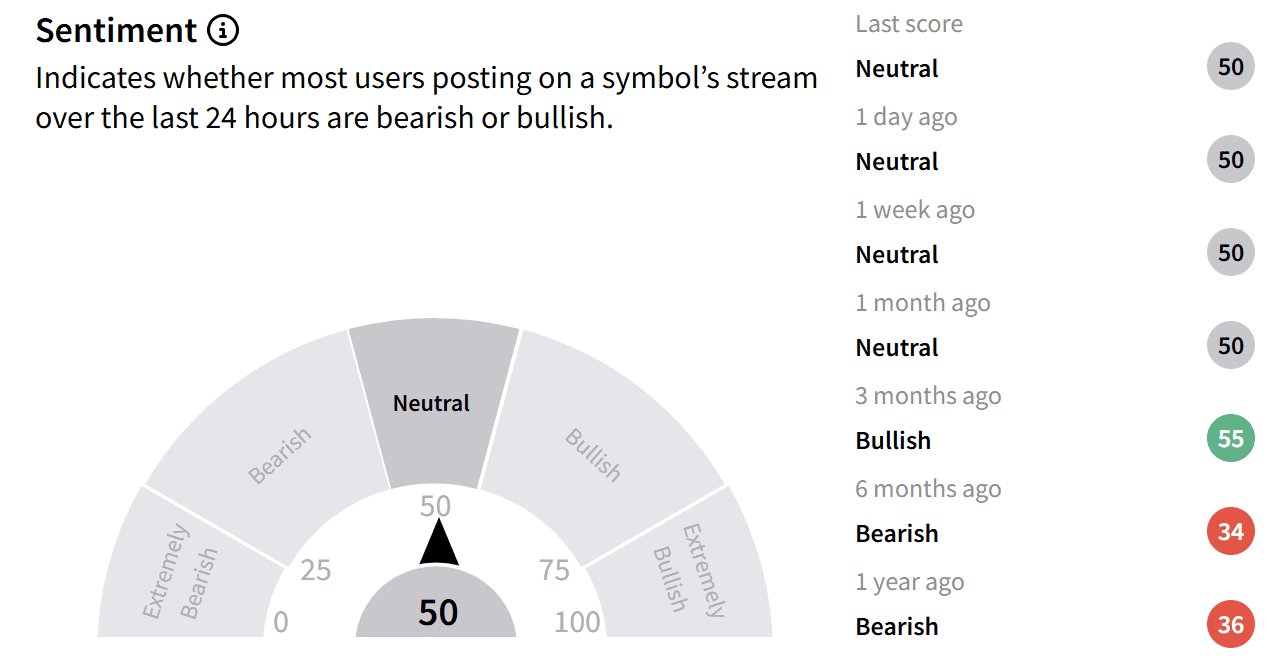

On Stocktwits, retail sentiment around the stock has dipped over the last quarter to ‘normal’ from ‘bullish’.

Looking ahead, management expects to advance sustainable aluminum packaging, achieve over 10% growth in comparable diluted EPS, increase economic value added (EVA), generate strong free cash flow, and continue long-term value returns to shareholders.

Ball’s stock has declined 4% over the past year and remains relatively flat in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Trump Tariff Announcement Applies Emergency Brakes On Bitcoin Rally: Retail Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)