Advertisement|Remove ads.

American Airlines and Southwest Airlines Report Their Earnings Thursday Before The Bell: How Is Retail Treating Them?

Retail investors are maintaining caution ahead of the earnings announcement by Southwest Airlines and American Airlines on Thursday. The lack of enthusiasm follows a sluggish outlook posted by some of their peers in recent weeks. Both Delta and United Airlines reported decent earnings but failed to generate investor enthusiasm with their cautious outlooks. As we move toward the end of the week, here’s a look at how retail investors are treating Southwest and American Airlines.

1. Southwest Airlines: The low-cost carrier is expected to report earnings per share (EPS) of $0.52 during the second quarter as compared to $1.09 reported in the same period a year ago. Revenue is expected to come in at $7.35 billion for the quarter, according to a Street estimate. Retail investors are taking a cautious approach on the stock ahead of the earnings announcement as the outlook announced by some of the firm’s peers in recent days have disappointed investors.

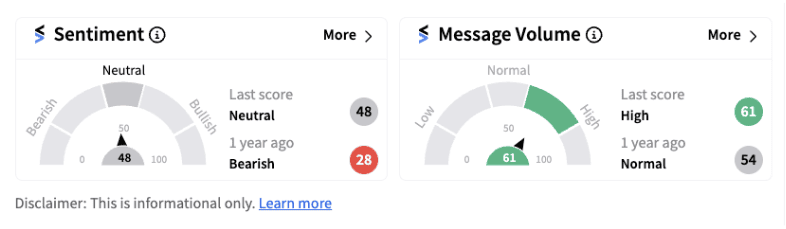

The Stocktwits sentiment meter is currently trending in the neutral territory (48/100), having risen from the bearish zone a day ago. The stock hasn’t had a great run this year, having lost over 4% on a year-to-date (YTD) basis. Meanwhile, TD Cowan has recently cut its price target on the stock from $26 to $19. Given that the stock is currently trading near the $27 mark, the latest price target reduction leaves a potential downside of over 29%. The company reports earnings on Thursday, July 25th before the bell.

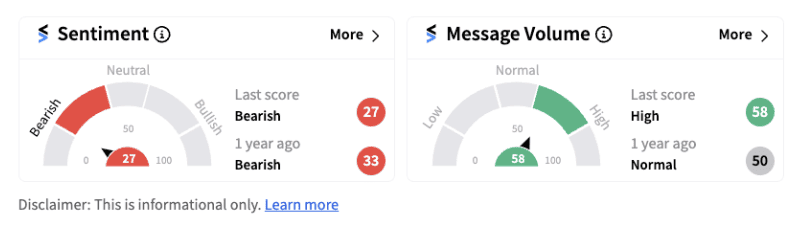

2. American Airlines: The firm is expected to report EPS at $1.06 as compared to $1.59 reported in the same quarter a year ago when it reports Thursday, July 25th before the bell. Revenue is projected to come in at $14.40 billion, according to a Street estimate. Retail investors are not optimistic about the stock ahead of its earnings announcement. The Stocktwits sentiment meter is currently trending in the bearish territory (27/100) supported by high message volumes. Recently, Bernstein SocGen Group downgraded the stock to ‘Market Perform’ from ‘Outperform’ while cutting the price target to $12 from $18 earlier. Notably, the stock has already had a bad first half, losing over 22% on a year-to-date basis.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)