Advertisement|Remove ads.

Golden Ocean CEO Says Company Using Current Market Weakness To Upgrade Fleet: Retail Sentiment Hits Year-High After Q4 Beat

Golden Ocean Group (GOGL) shares rose nearly 3% in Wednesday’s pre-market session after the dry bulk shipping company’s fourth-quarter earnings surpassed Wall Street estimates.

Revenue declined 17% year-over-year (YoY) to $210.97 million but topped an analyst projection of $176.64 million. However, adjusted earnings per share (EPS) for the quarter stood at $0.06 compared to a Street estimate of $0.19, according to FinChat data. Net income fell 19% YoY to $39 million.

The company incurred a total of $34.3 million in dry-docking expenses in the fourth quarter (Q4) for 13 dry-dockings, compared to $9.7 million for five dry-dockings in the third quarter (Q3) of 2024.

Interim CEO Peder Simonsen said the company is utilizing the current market weakness to upgrade its fleet significantly.

“Looking ahead, we are encouraged by the continued strength in global dry bulk demand, the supportive supply-side dynamics, and the structural tailwinds in key commodities, all of which reinforce our long-term confidence in the market and our ability to create value for shareholders,” he noted.

The company exercised a purchase option for eight vessels chartered on long-term leases from SFL Corporation for $112 million. It said a new $90 million credit facility will partially finance the acquisition.

Golden Ocean has announced a cash dividend of $0.15 per share for Q4 2024, payable on or about March 21, 2025, to shareholders of record on March 11, 2025. During Q4, the company repurchased 625,000 shares at an aggregate purchase price of $5.7 million, or $9.08 per share.

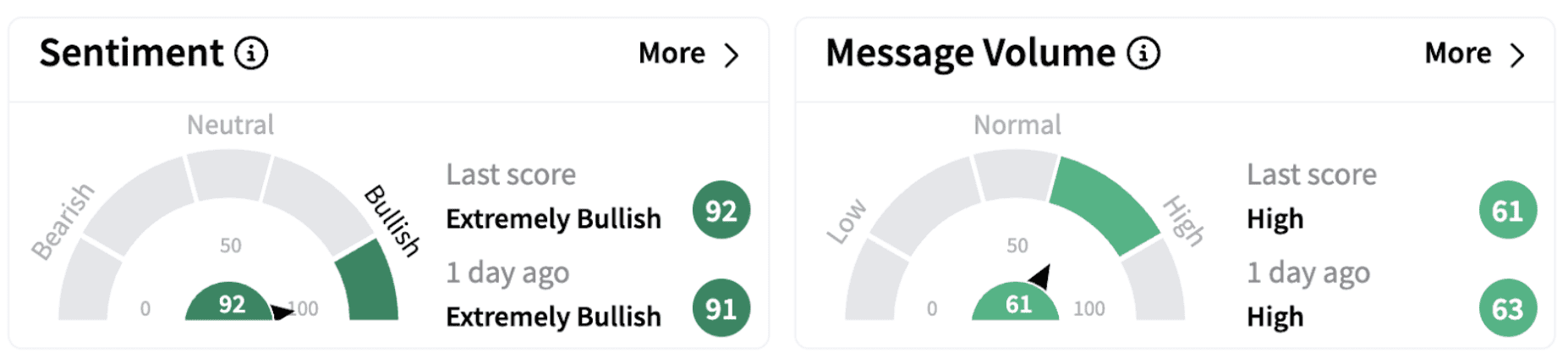

On Stocktwits, retail sentiment climbed further into the ‘extremely bullish’ territory (92/100), hitting a one-year high. The move was accompanied by significant retail chatter.

GOGL stock has gained 0.64% this year before considering Wednesday’s pre-market pop. However, the shares are down over 18% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)