Advertisement|Remove ads.

American Express Stock Slips Ahead Of Q3 Earnings: Retail Sentiment Turns Bullish

American Express Co.'s shares fell 1% in early premarket trading on Friday, although Stocktwits sentiment inched higher, ahead of the company's third-quarter results release before the market opens.

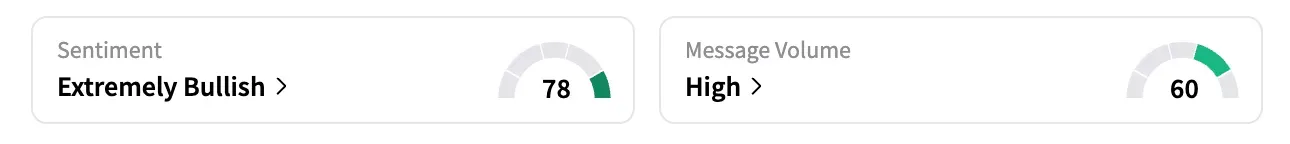

The retail sentiment shifted to 'extremely bullish' from 'bullish' the previous day, and 24-hour message volume rose 600%.

Analysts expect the financial services giant to report an 8.5% growth in quarterly revenue to $18.1 billion, according to consensus estimates from Koyfin. That would be a tad below the 9.3% rise in the second quarter, which was the highest pace since Q1 2024. Adjusted EPS is expected to rise 14% to $3.98.

Notably, RBC Capital Markets, HSBC, Barclays, and JPMorgan, among others, raised their price target on the stock earlier this month.

In their investor note, Barclays analysts said credit performance "remains in a good place after two plus years of tightening." The rate rally earlier this quarter brought a wave of optimism to the mortgage market, but that momentum has since cooled. Rates are expected to remain elevated through 2026, the research firm said, signaling a more cautious outlook for credit players.

"Solid network volume growth should help results, but lower ICS (International Card Services) profits could offset some of that momentum," ZacksResearch said in a post on Stocktwits.

Currently, 16 of the 29 analysts covering American Express rate the stock 'Hold,' 10 rate it 'Buy' or higher, and three rate it 'Sell' or lower, according to Koyfin data. Their average private target of $334.21 implies a mere 3.5% upside from the stock's last close.

Year-to-date, the AXP stock is up nearly 9%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Solar EV Maker Aptera Motors' Stock Slips Premarket After Direct Listing: Retail Stays Optimistic

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)