Advertisement|Remove ads.

Anywhere Real Estate Stock Falls Premarket On Worse-Than-Feared Earnings: Retail Cheers Upbeat Revenue, $100M Cost Savings Projection

Anywhere Real Estate Inc. (HOUS) shares fell nearly 3% in Thursday’s pre-market session after the company reported a wider-than-expected loss in the fourth quarter.

The company reported an earnings loss of $0.58 compared to an estimated loss of $0.29. Revenue rose 21% to $1.36 billion year-on-year (YoY), compared to a Wall Street estimate of $1.28 billion.

The firm reported operating earnings before interest, tax, depreciation, and amortization (EBITDA) of $52 million, up $24 million YoY.

Anywhere said it witnessed continued strength in luxury with Coldwell Banker Global Luxury, Corcoran, and Sotheby's International Realty brands significantly outperforming the market with closed transaction volume increasing nearly 20% YoY.

The company also grew its high-margin franchise network by adding 28 franchisees in the fourth quarter.

Anywhere Real Estate said it expects to realize further cost savings of approximately $100 million in 2025, which is expected to be offset in part by inflationary pressures and investments. It expects operating EBITDA for 2025 to be about $350 million.

The company’s total corporate debt, including the short-term portion, net of cash and cash equivalents (net corporate debt), totaled $2.4 billion as of Dec. 31, 2024, and it ended the quarter with cash and cash equivalents of $118 million.

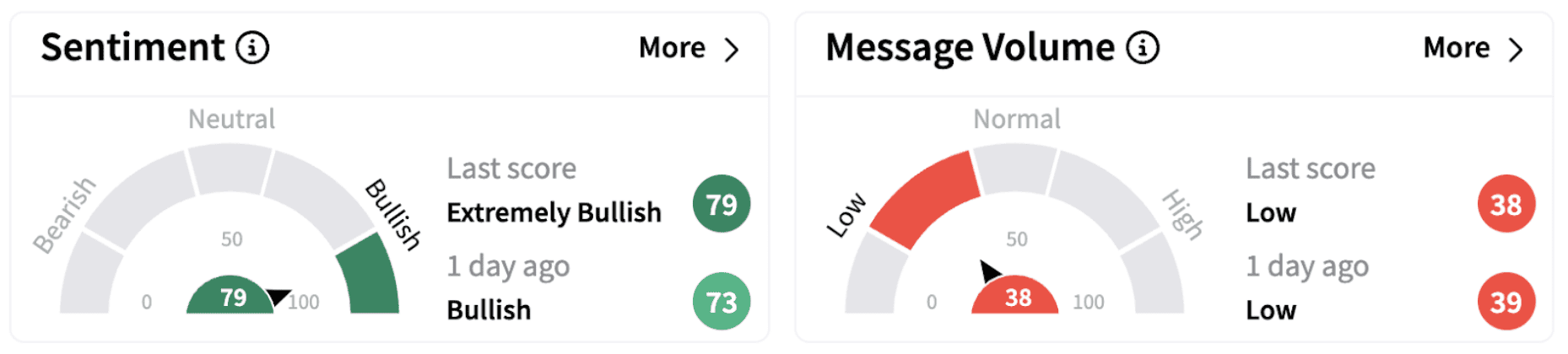

On Stocktwits, retail sentiment climbed into the ‘extremely bullish’ territory (79/100) from ‘bullish’ a day ago.

Last month, Barclays analyst Matthew Bouley lowered the firm's price target on Anywhere Real Estate to $3 from $4 while keeping an ‘Underweight’ rating on the shares.

Anywhere Real Estate shares have gained over 11% in 2025 but are down over 52% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)