Advertisement|Remove ads.

Apple Analyst Says iPhone Growth May Stall After Tech Giant Delays AI-Powered Upgraded Siri Launch: Retail’s Bearish

The Apple, Inc. (AAPL) feed on Stocktwits saw brisk activity after a bullish analyst cut his price target for the stock by roughly 9%.

In a note released Wednesday, Morgan Stanley analyst Erik Woodring reduced the price target for Apple stock to $252 from $275. The updated price target implies a more than 12% downside from current levels.

Morgan Stanley has an ‘Overweight’ rating for the stock.

According to the analyst, the postponement of an advanced Siri integration into Apple Intelligence is likely to temper the next 12 months’ iPhone upgrade rates compared to his prior expectations.

He now sees a more gradual path to shortening the iPhone upgrade rates.

The analyst’s previous thesis for stock outperformance over the next 12 months was premised on a combination of advanced artificial intelligence (AI) features, broader global distribution of these features, upgraded iPhone hardware, and a new iPhone 17 form factor catalyzing an iPhone upgrade cycle starting in the fiscal year 2026.

Woodring noted that an upgraded Siri personal assistant was the number one AI feature prospective iPhone upgraders were interested in when upgrading. He now thinks the new advanced Siri may not be available until after the iPhone 17 launch.

Therefore, the analyst materially lowered his calendar-year 2025 iPhone shipment forecast to 230 million, suggesting flat year-over-year (YoY) growth. He sees a modest 6% growth in the next fiscal year.

Woodring also factored in incremental cost headwinds from China tariffs.

As such, the analyst now estimates earnings power of $8 in the fiscal year 2026, down from his previous estimate of $8.52.

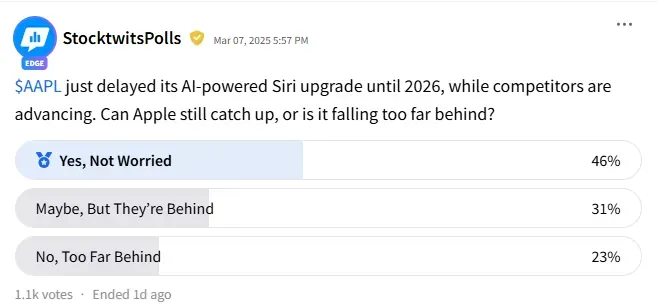

However, Stocktwits users gave a better projection for Apple. A Stocktwits poll that received responses from over 1,000 users found that 46% of the respondents believed that notwithstanding the delay in the AI-powered Siri upgrade, Apple can still catch up with the competition.

However, a sizable 31% were unsure but felt Apple was behind, while 23% definitively opined that Apple was “too far behind.”

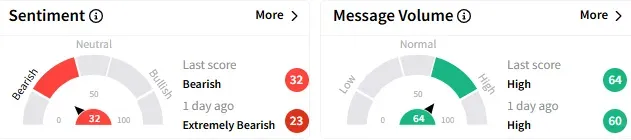

Retail sentiment on the platform improved slightly but was ‘bearish’ (32/100) compared to the ‘extremely bearish’ mood that prevailed a day ago. The message volume on the Apple stream remained high.

A bearish user suggested they wouldn’t buy Apple shares as it traded at a price-earnings multiple of 35 despite the company’s anemic growth.

Apple stock fell 1.65% to $217.20 in early trading. The stock has lost nearly 12% since the start of the year

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: UiPath Stock Rises Ahead Of Q4 Results Due Wednesday: Retail’s Convinced Of Long-term Potential

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)