Advertisement|Remove ads.

Apple Heads For Its Softest Year In Three — Is AI The Missing Catalyst Wall Street’s Waiting For?

- Apple’s stock has recovered in the second half but continues to lag mega-cap peers, weighed down by slowing iPhone and investor unease over delayed AI execution.

- Despite near-term skepticism, core fundamentals remain resilient, with improving iPhone shipment trends—particularly in China.

- 2026 could emerge as a turning point, as deeper AI integration via a revamped Siri reignites upgrade cycles.

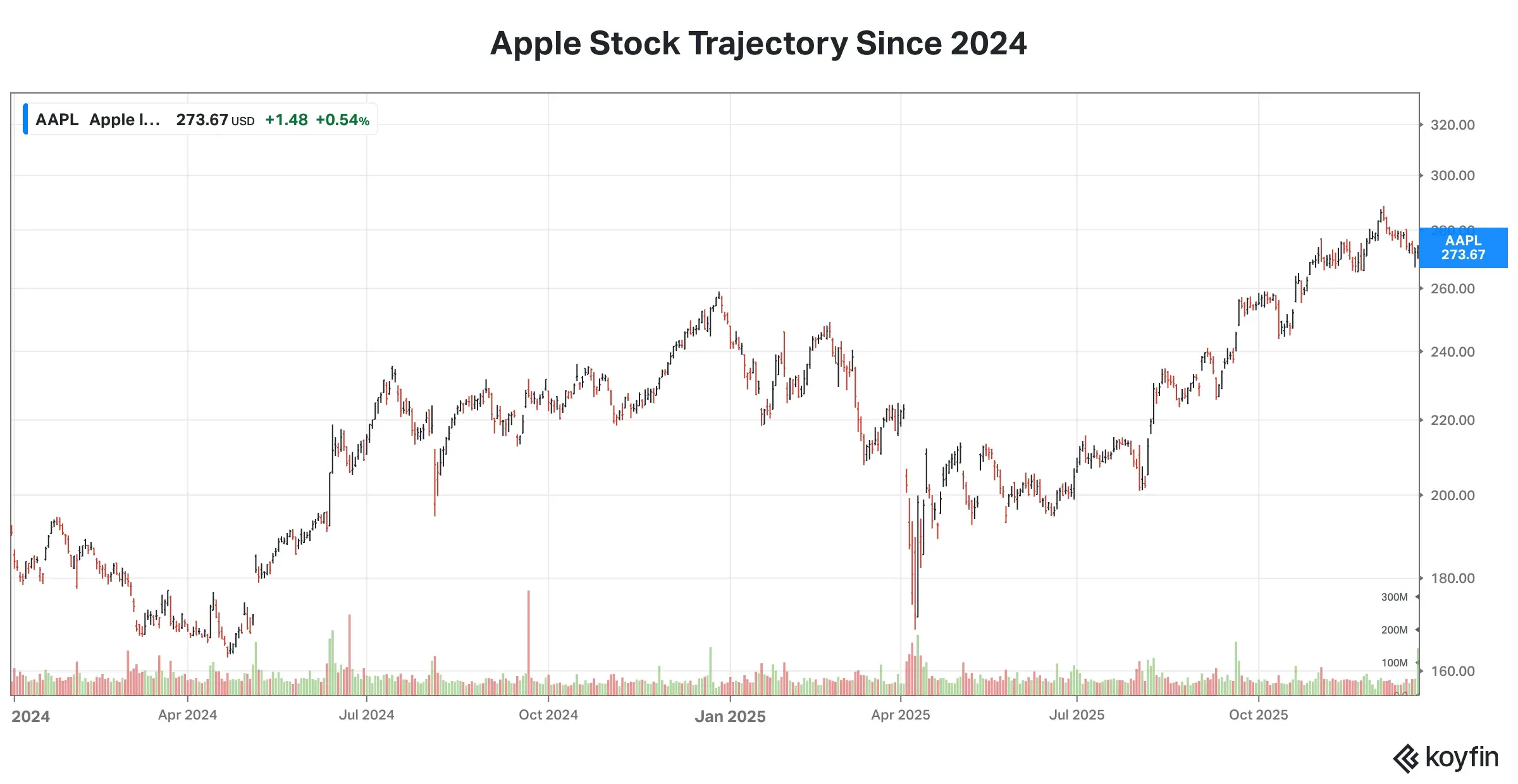

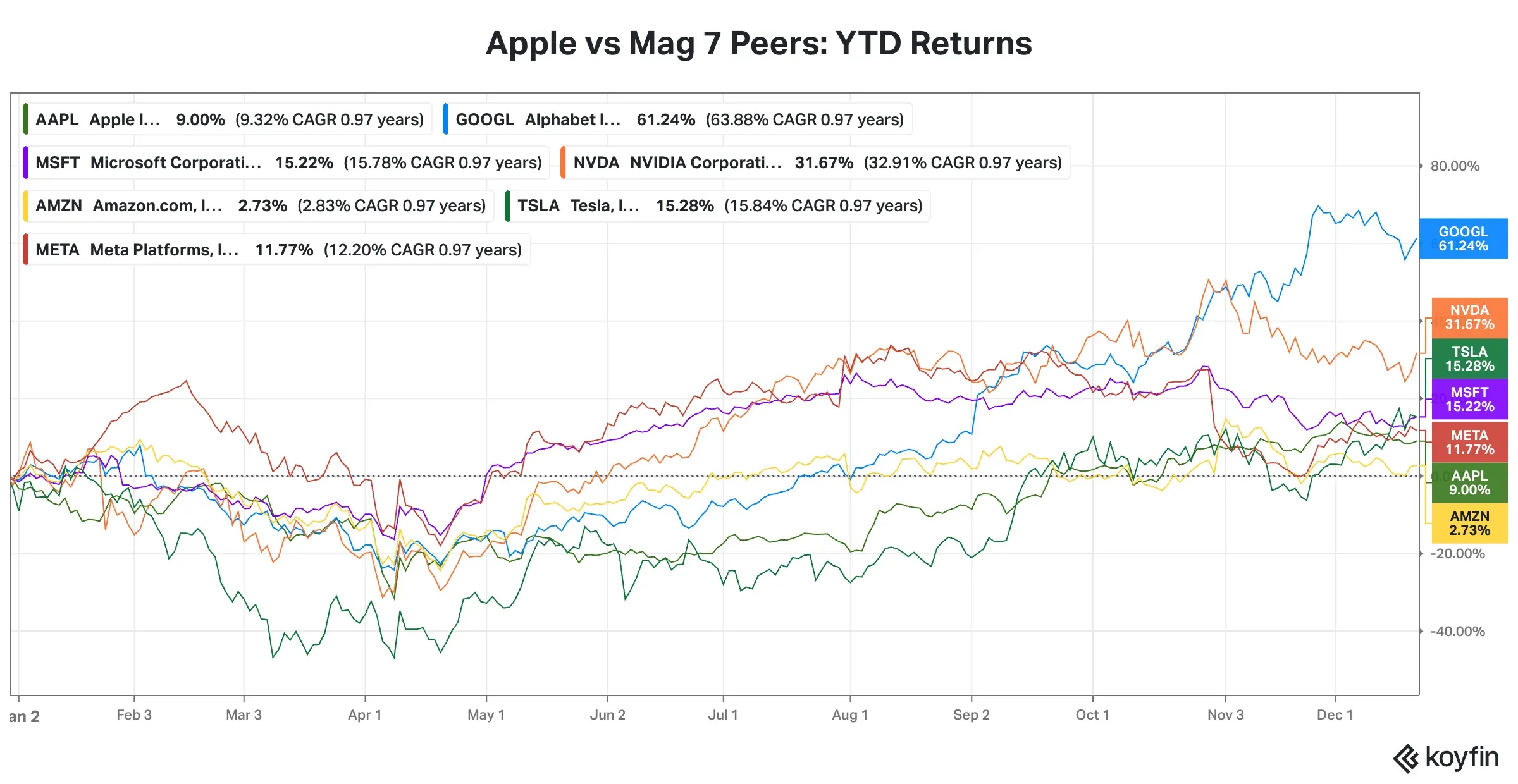

After a forgettable performance in the first half of the year, Apple’s (AAPL) stock has staged a comeback in the second half of the year. Even with these gains, the stock is on track to record a more muted gain relative to its mega-cap tech peers. Granted, the stock scaled a new peak ($288.62) this month, but the returns are underwhelming, at least relatively.

Does Apple stock no longer hold out promise for cherry-picking investors? What has held them back?

Apple’s Checkered Stock Run

Cupertino’s stock entered the year a little jaded after a nearly eight-month run culminated in a new high of $260.10 on Dec. 26, 2024. It was locked in a downtrend until the Trump-tariff market bottom of early April. Since then, the stock has been showing a fits-and-starts recovery, with the uptrend solidifying from November.

Source: Koyfin

Source: Koyfin

The stock has generated a positive return for the year, but it is the second-worst performer among the Magnificent Seven group.

Source: Koyfin

Source: Koyfin

Why Apple’s Stock Has Lagged

Very often, Apple’s limited progress with its artificial intelligence (AI) initiatives has been blamed for the stock setback. Incidentally, the same headwind propped up the stock when most AI-exposed big names took a tumble in November amid the rising fears about a bubble building. The stock weakness, therefore, may have to do with much more than the delay.

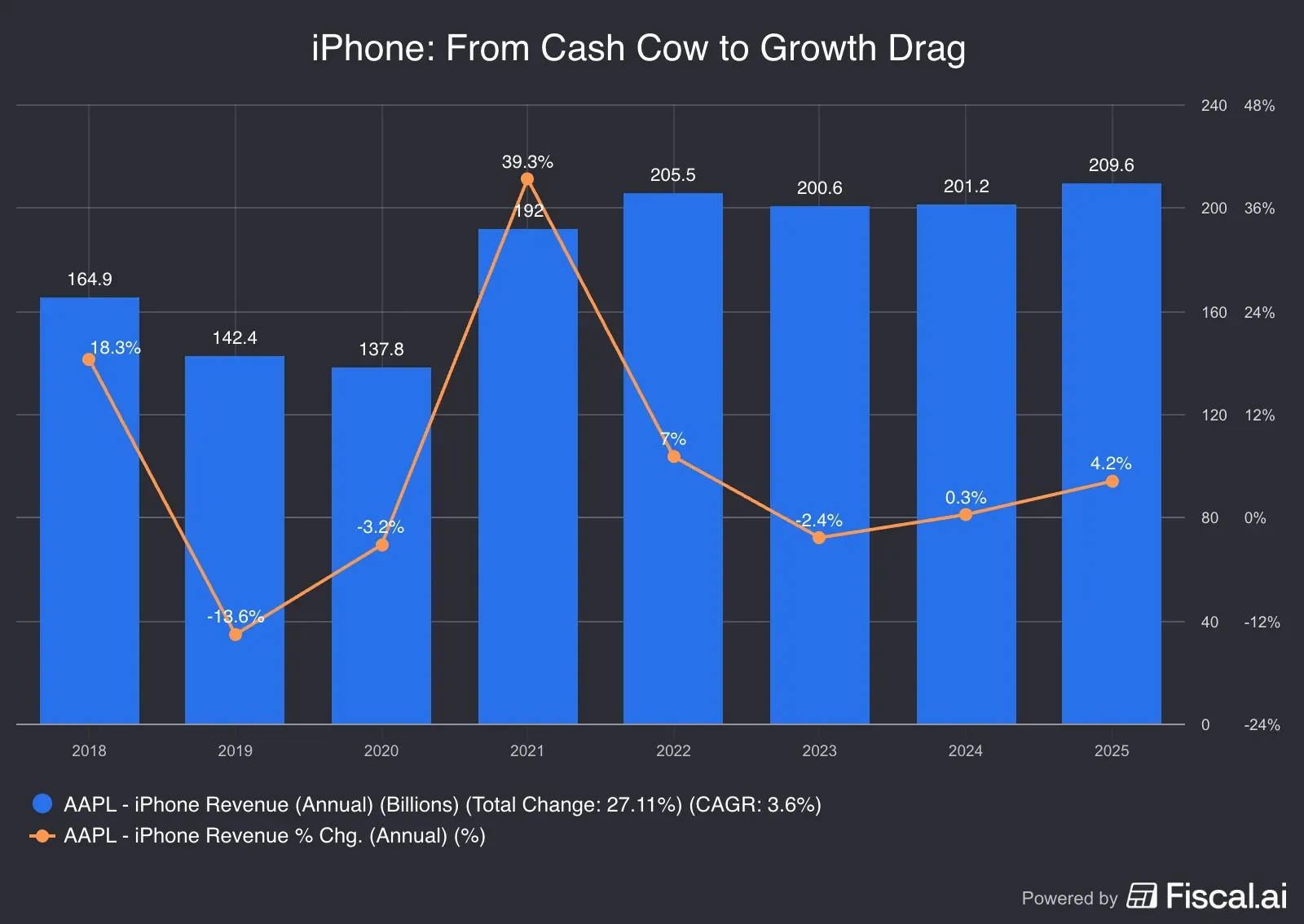

iPhone, the cash cow, has seen declining revenue growth after the post-COVID-19 spike seen in 2021. Nevertheless, iPhone sales accounted for 50% of the company’s total revenue in the fourth quarter ended Sept. 2025, and the installed base of iPhones clocked a record.

Source: Fiscal.ai

Lack of innovation and any meaningful AI integration, and competitive pressure in China has all served to keep volumes from growing substantially.

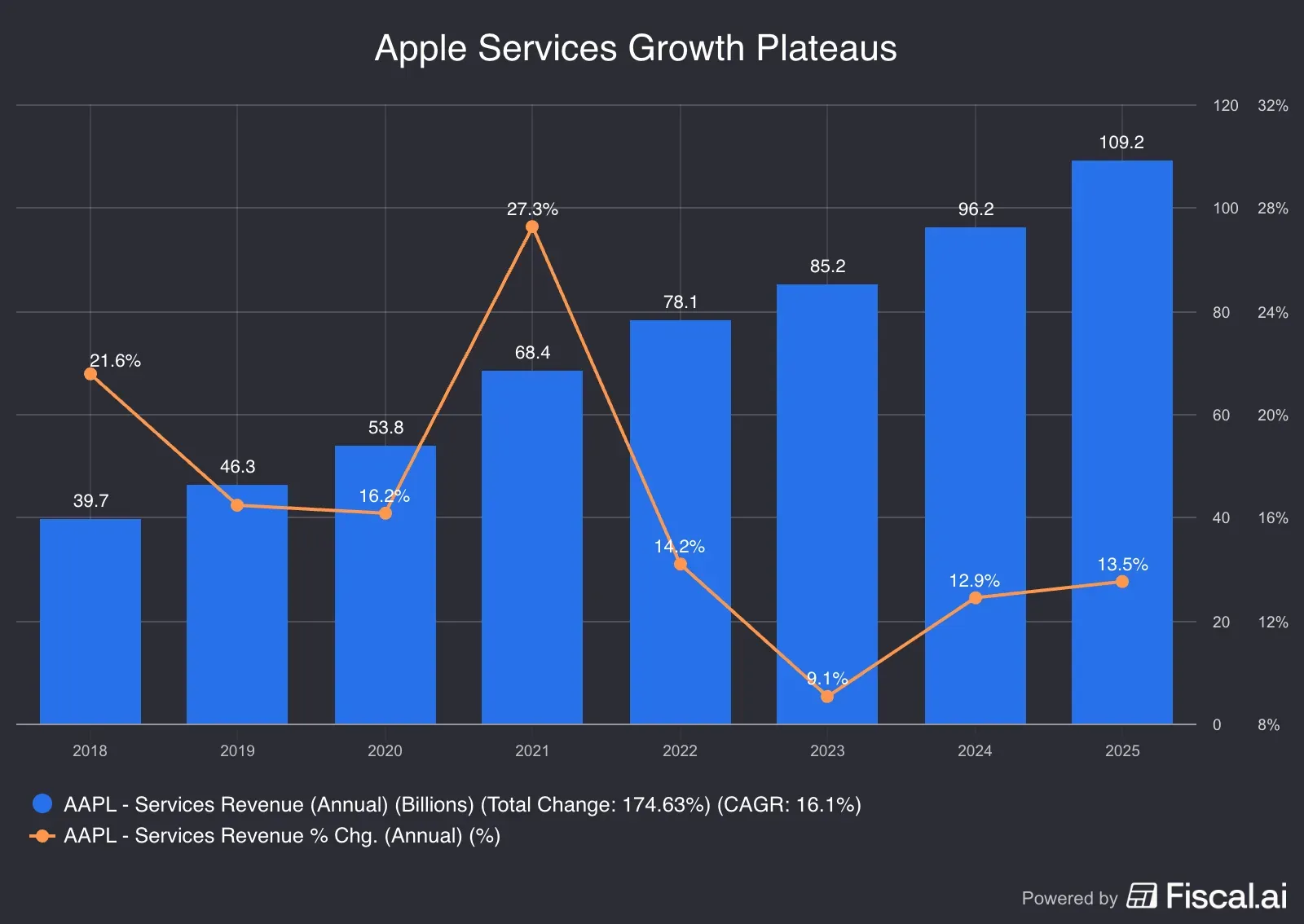

The services business, which has a higher margin, still accounts for a sizeable portion of the total revenue, but the rate of growth has slowed substantially from the 2021 peak (27.3%).

Source: Fiscal.ai

Apple has not been successful in bringing any breakthrough product to the market since the iPhone. The Vision Pro mixed-reality headset, launched in 2024, could not make much of an impact due to a host of reasons, and the Apple Car project was quietly shelved. The company’s recent string of executive departures has raised doubts among investors about its long-term direction.

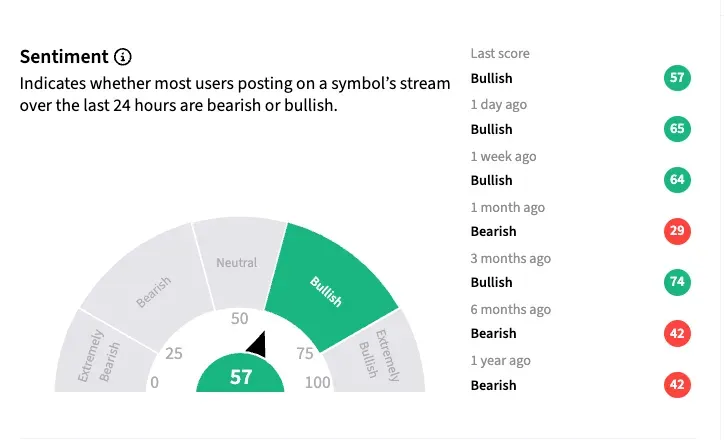

What Retail Feels About Apple Stock

Apple’s recent stock strength has managed to turn around retail traders’ sentiment. After wallowing in ‘bearish’ terrain for much of the year, the mood has turned ‘bullish’ in recent weeks.

A watcher expressed optimism that Apple’s stock would hit $300 as it launches AI glasses and Camera AirPods. Another user pointed to strong uptake of the company’s products. “Apple stores in London are packed out, good sign,” they said.

Will 2026 Mark An Inflection Point?

Data points on iPhone uptake during the December quarter, the busiest one for Apple, raise hopes of substantial numbers. In a report released earlier this month, IDC said accelerated Apple’s holiday shipments will help worldwide smartphone shipments to rise 1.5% year over year in 2025.

Commenting on Apple’s strength, IDC’s Senior Research Director Nabila Popal said:

“Apple is set to have a record year in 2025 with shipments forecast to cross 247 million units, thanks to the phenomenal success of its latest iPhone 17 series.”

The analyst said the iPhone 17 is seeing massive demand in China, ranking first in October and November and taking more than 20% share, miles ahead of the competition. IDC, therefore, revised Apple’s fourth-quarter China sales forecast from 9% to 17%.

Apple could also get a shot in the arm from deepening its AI integration. According to Morgan Stanley’s Erik Woodring, Apple will become a leading distributor of AI technologies with a re-release of Siri in spring 2026.

“Collaboration with external partners (e.g. Google Gemini) — and therefore a smarter Siri/Apple Intelligence — potentially will further accelerate iPhone replacement cycles in the medium term, and Apple may introduce a paid tier for Apple Intelligence as early as 2027.”

Morgan Stanley’s Fall survey showed Apple Intelligence ranked among the top 5 reasons iPhone owners cited for upgrading to eligible models — a key driver for Apple to go the AI way in a deeper, quicker fashion.

As part of his 2026 predictions, Gene Munster, the Managing Director at Deepwater Asset Management, said Apple will launch the new AI-powered Siri before April 30, 2026, and that it will be well received. He went a step further and predicted that Apple will be the best-performing Mag 7 stock in the first half of 2026, helped by “iPhone exceeding expectations in the December and March quarters along with an expanding multiple as investor optimism grows on the belief that the new Siri (likely April) and improved Apple Intelligence will be a growth driver in FY27.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)