Advertisement|Remove ads.

The SpaceX IPO Isn't Even Official — And Billionaire Hedge Fund Titans Are Already Pitching Elon Musk With Smart Plans

- Bill Ackman floated an unconventional, fee-free SpaceX IPO via Pershing Square's SPARC structure, with Tesla shareholders getting first dibs.

- Daniel Loeb quickly countered with a rival proposal, signaling that Wall Street heavyweights are already circling.

- Retail and institutional enthusiasm around SpaceX is being fueled by fundamentals, including Starlink’s rapidly expanding LEO constellation, unmatched launch cadence, and growing relevance to AI.

The SpaceX IPO hasn't even been announced — and yet two of Wall Street's most recognizable hedge fund managers are already lining up publicly to pitch Elon Musk on how they think it should be done.

As an event-filled 2025 for markets draws to a close, Elon Musk has kept traders hooked until the very end. Speculation is mounting that his SpaceX venture could go public in the new year, a possibility the billionaire has all but confirmed through a series of social media posts. Market chatter suggests the company is targeting a blockbuster public debut at around $1.5 trillion, a valuation unprecedented in listing history.

Ackman Recommends SPARC Route

The initial overture came from Pershing Square founder Bill Ackman. Tagging Musk, the hedge fund manager asked in a social media post — “What if we took @SpaceX public by merging it with Pershing Square SPARC Holdings, Ltd. (SPARC), a new form of acquisition company that was approved by the @SECGov?”

SPARC, which stands for Special Purpose Acquisition Rights Company, is an investment vehicle, considered a variation of the more widely known Special Purpose Acquisition Company (SPAC), aka shell company.

Pershing Square gained approval for the SPARC structure in September 2023 following a two-year review, and shortly after, the firm began distributing SPARs to former Pershing Square SPAC holders, giving them the right to invest in future deals. Another advantage of a SPARC is that it has up to 10 years to find the right target company.

Ackman touted the advantages a SPARC deal could offer SpaceX, including:

-Rewarding existing Tesla shareholders by distributing SPARs to them, which they can use to invest in the SpaceX IPO or sell it to someone, or get cash.

-Providing an opportunity to invest in Musk’s artificial intelligence (AI) startup, xAI, through ownership in Pershing Square SPARC Holdings II SPARs, which would invest when xAI chooses to go public

-A committed $4 billion capital (fixed price per share) by Pershing Square

-No underwriting fees or dilutive securities to be issued (ensuring 100% common stock capital structure and no transaction cost)

Ackman also said SpaceX could raise any amount of capital by adjusting the exercise price of SPARs. He also suggested an expedited timeline for listing:

“We could do due diligence and enter into a definitive agreement committing to the transaction within 45 days, at which point it would be certain that SpaceX would go public at a fixed valuation subject only to SEC approval of the merger proxy/registration statement.”

The commitment made by Pershing Squae would not be subject to market conditions. Ackman flagged the prospect of announcing the transaction by mid-February.

Loeb Wants Piece of SpaceX Pie

The pitch barely had time to settle before a rival voice jumped in. New York-based hedge fund Third Point’s founder, Daniel Loeb, also threw his hat in the ring. “Get in line @BillAckman,” Loeb said, adding that a merger with London-listed Malibu Life Holdings, a licensed life and annuity reinsurer based in the Cayman Islands and a successor to Third Point’s closed-end fund, would offer a superior value to both SpaceX and Malibu Life shareholders.

Alt Listing Plans Better Bet?

As Ackman pointed out, a SPARC listing could save the typical 3-7% underwriting fees for the traditional IPOs and the 5%-5.5% fees for a conventional SPAC route. Direct listing, however, carries no underwriting fees.

A direct listing is a process by which private companies list their existing shares on a stock exchange, allowing them to sell directly to the public. Insiders gain immediate liquidity, unlike the lockup period associated with traditional IPOs, and for companies, it offers a cheaper and quicker way. However, it raises no capital for the company.

Social media users were quick to take swipes at Ackman and Loeb. Tagging both hedge fund managers, a user asked, “Gents the desperation is oozing - how many deals have either of you gotten done before through such public overtures?” Another called it an “embarrassing idea.”

The Lure of SpaceX

SpaceX, founded in 2002, is in the business of designing, manufacturing, and launching advanced rockets, including reusable ones, and spacecraft. Its Starlink subsidiary provides low-latency broadband internet services using a large constellation of satellites in low Earth orbit (LEO), which are much closer to the Earth than traditional satellite systems.

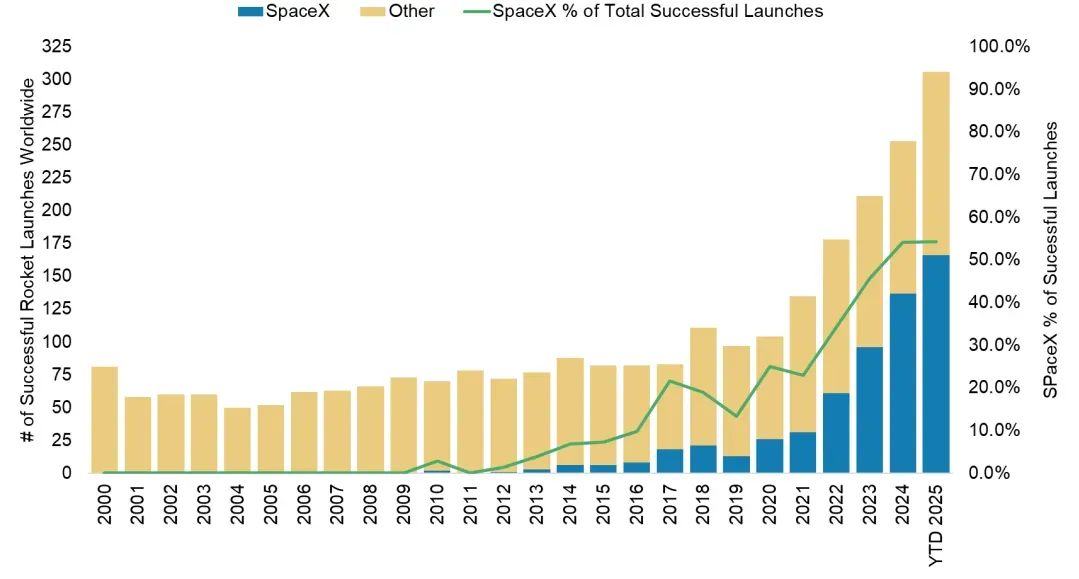

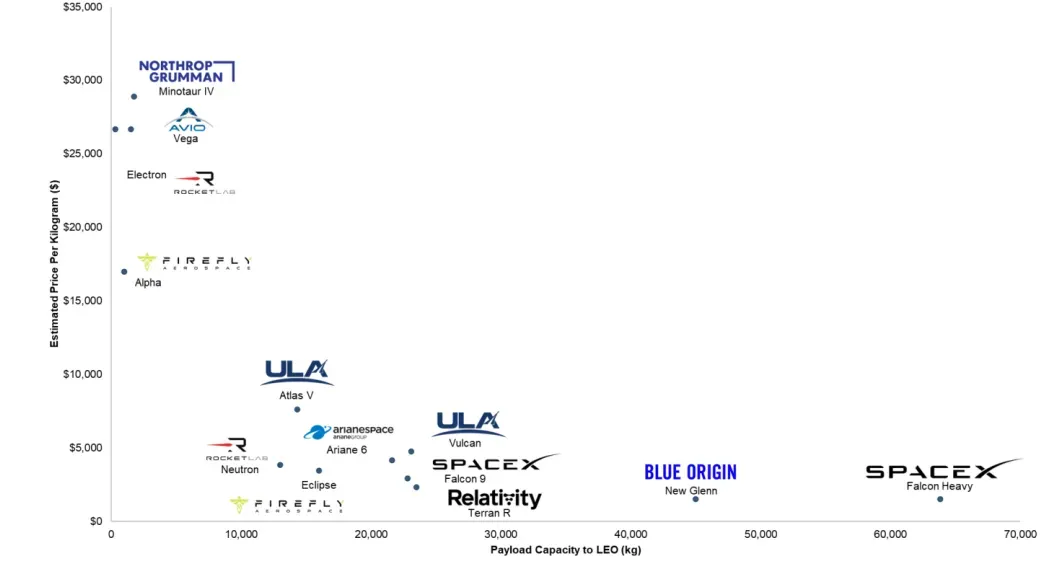

Starlink now has more than 9,000 satellites in orbit, and the average time between launches in 2025 is 2 days, according to Morgan Stanley. The company’s launch scale has helped SpaceX dominate the LEO space, and it also offers the greatest capacity at the most affordable price.

Source: Morgan Stanley

Source: Morgan Stanley

Source: Morgan Stanley

Morgan Stanley calls reusable rockets elevators to space, allowing humans and AI to expand into the new frontier. SpaceX, due to its inherent advantages as a rocket company, is likely to benefit as AI companies look to space as an alternative for building data centers.

According to a Forbes report, Musk’s 42% stake in SpaceX is now valued at $336 billion, going by the valuation used in the venture’s latest tender offer in December. SpaceX could be primarily instrumental in turning Musk’s status into a trillionaire when the IPO happens, the report said.

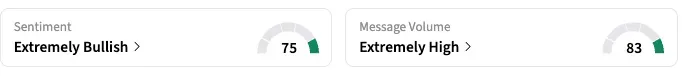

On Stocktwits, retail sentiment toward SpaceX is ‘extremely bullish.’

Space Companies On Tear

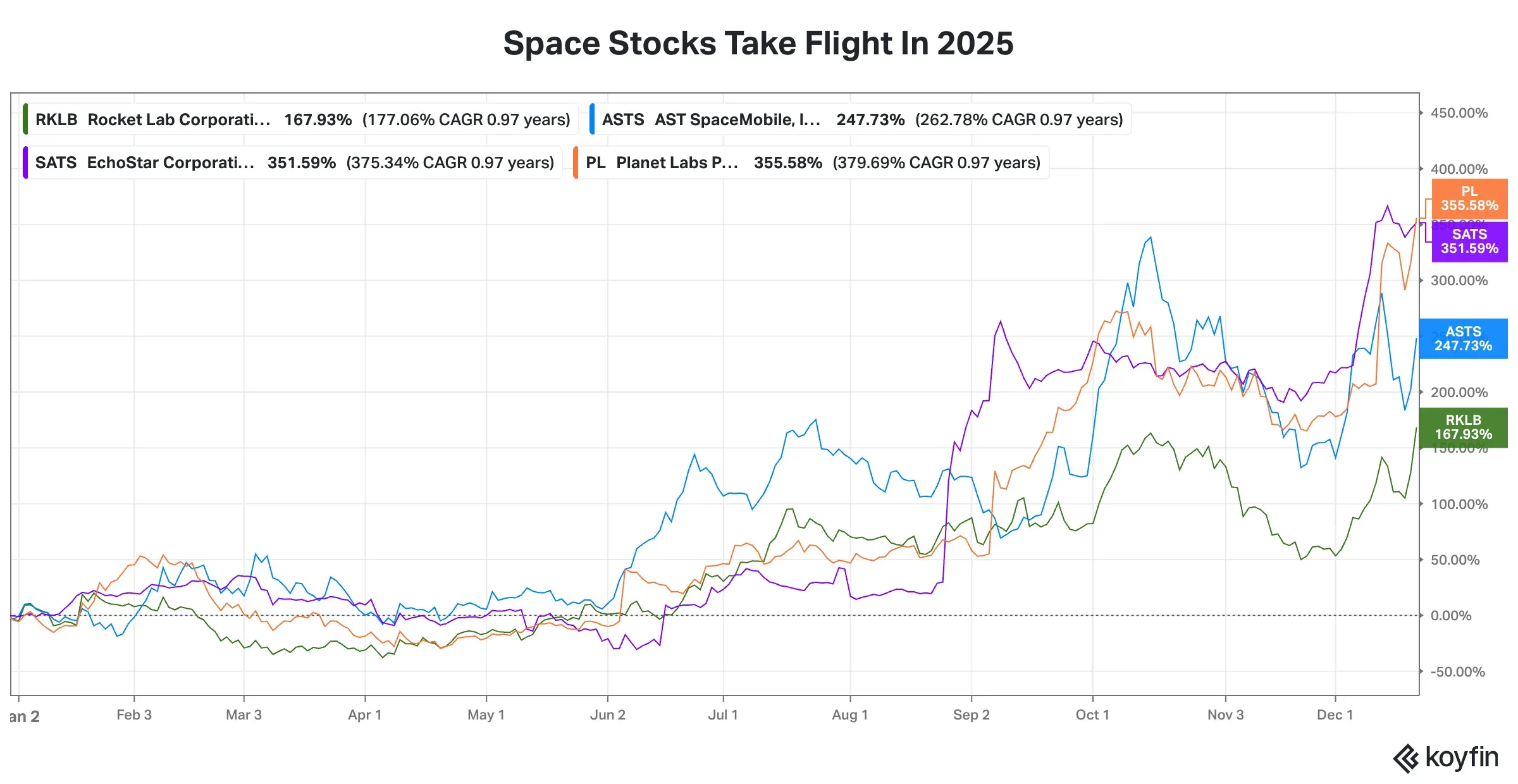

Given the brisk launch activity and other opportunities, such as data centers, publicly listed space, and space-based communication services companies, have been on a tear this year.

Source: Koyfin

Source: Koyfin

Media reports have also raised the possibility of SpaceX going public through a reverse merger with Echostar (SATS), given that the Musk-led company has acquired spectrum from the latter for its Starlink business in two transactions this year.

However, the man who matters most has yet to weigh in on the route forward. Given the maverick streak Musk has consistently displayed—often favoring unconventional, high-stakes decisions—it would not be surprising if he opted for the boldest, riskiest path to the public markets.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)