Advertisement|Remove ads.

Retail Investors Abuzz Over Apple's Reported Plan To Shift US iPhone Assembly To India

Apple, Inc. (AAPL) is reportedly considering manufacturing all its iPhones bound for the U.S. in India as a workaround for the hefty tariffs President Donald Trump's administration has levied on Chinese imports.

The tech giant's supply chain is highly concentrated in China, and it began taking baby steps toward diversification well before the tariff storm struck.

Apart from China, the company's flagship hardware product is now made in India and Vietnam, although parts of the device come from across the globe.

A Financial Times report, citing people familiar with the matter, said the tariff situation has expedited the diversification, which is underway. Apple now plans to source all of the iPhones it sells in the U.S. from India by the end of 2026.

The report said the tech giant sells about 60 million iPhones annually in the U.S.

According to estimates by Morgan Stanley analyst Erik Woodring, India currently produces 30 million to 40 million units of iPhones out of which over 12 million is earmarked for domestic sales.

At the midpoint of the India output estimate and accounting for Indian sales, Apple may have to augment its iPhone production in India by about 37 million units or double the capacity.

Apple's contract manufacturers in India include Foxconn and Tata Electronics.

Following a series of moves and countermoves, the Trump administration applied 145% additional tariffs on Chinese imports, although electronics were exempted from the bucket later.

iPhones are still subject to a 20% across-the-board China import levy.

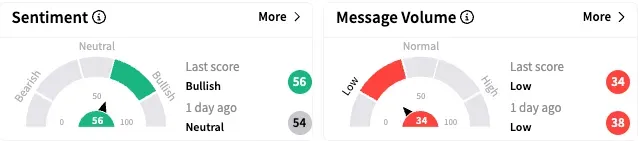

On Stocktwits, retail sentiment toward Apple stock turned to 'bullish' (56/100) by late Thursday from 'neutral' a day ago, although the message volume stayed 'low' relative to historical levels.

A bullish watcher lauded Apple for the rumored plan. "China just got the next dagger to their collapsing economy," they said.

Some users expressed optimism regarding the reports of China mulling relief for some U.S. goods.

Another user predicted the stock would rip higher after next week's earnings. "Easy money," they said, potentially referring to the stock's depressed trading levels.

Some were also hoping for a buyback announcement from Apple next week.

The Tim Cook-led company will report quarterly results on May 1, after the market closes.

According to the Finchat-compiled consensus, the company is expected to report earnings per share (EPS) of $1.61 and revenue of $94.60 billion for the fiscal year 2025 second quarter.

Apple stock ended Thursday's session up 1.84% at $208.37, although it trades well below the Dec. 26 intraday high of $260.10.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)