Advertisement|Remove ads.

Apple Stock Falls Over 2% After Analyst Highlights Reduced iPhone Orders And $89 Million Fine By CFPB: Retail Remains Bullish

Apple Inc. ($AAPL) shares dropped 2.5% on Wednesday following TF International Securities analyst Ming-Chi Kuo's report highlighting lowered iPhone 16 production estimates and an $89 million fine by the US Consumer Financial Protection Bureau (CFPB).

Kuo referenced industry estimates in a post highlighting that forecasts for total iPhone production over the next three quarters have also been lowered, indicating year-on-year declines across the board.

These cuts signal potential headwinds for Apple's iPhone revenue, which remains the company's biggest revenue driver, contributing nearly half of its total sales.

According to Kuo, while iPhone revenue in the upcoming fourth-quarter earnings may not immediately reflect the impact of these production cuts due to a favorable product mix, driven by higher production of the iPhone 16 Pro Max, the first half of 2025 could be more challenging.

Meanwhile, the CFPB has ordered Goldman Sachs ($GS) and Apple to pay $89 million because of the companies’ mishandling of their Apple Card partnership.

Apple neglected to send multiple Apple Card disputes to Goldman Sachs, the CFPB said. When Apple did inform Goldman of disputes, “the bank did not follow numerous federal requirements for investigating the disputes,” the watchdog said.

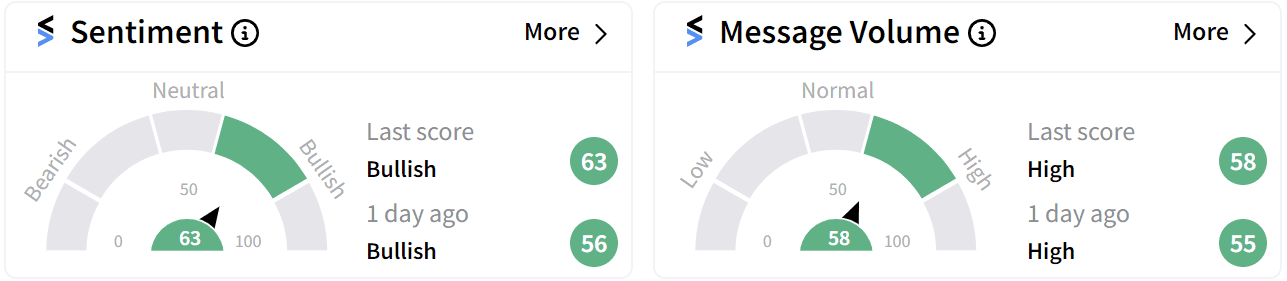

Retail sentiment on Stocktwits remains in the ‘bullish’ (63/100) territory with users unconvinced of Kuo’s analysis.

Apple is set to announce its fourth-quarter results on Oct. 31, with projections indicating revenue of $94.36 billion and earnings per share of $1.59, according to Stocktwits data.

Apple is currently the most-valued company in the world with a market capitalization of $3.59 trillion. The company’s stock has gained 24% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217223717_jpg_e05dddbc9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sea_ltd_jpg_b4cc09a88d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219834417_jpg_a7705b50b5.webp)