Advertisement|Remove ads.

Archer Aviation Stock Sinks On Wider Q4 Loss, But Retail Confidence Stays Airborne

Archer Aviation (ACHR) stock fell 11.6% in after-hours trading on Thursday after the company posted a bigger fourth quarter loss.

For the three months ended Dec. 31, the air-taxi company reported a net loss of $198.1 million, compared with a loss of $109.1 million, in the year-ago quarter.

The company reported an adjusted loss (before interest, taxes, depreciation, and amortization) of $94.8 million for the fourth quarter, widening from a $85.2 million loss a year earlier.

Archer Aviation, which is backed by United Airlines and Stellantis, said its total operating expenses ballooned to $124.2 million from $107.3 million in the year-ago quarter as it hired more people and spent more on testing efforts and manufacturing scale-up.

Archer said that Abu Dhabi Aviation, the largest commercial helicopter operator in the Middle East, plans to deploy the first of its Midnight series of aircraft later this year.

In February, Archer said it had raised $301.75 million in a funding round led by institutional investors including funds and accounts managed by BlackRock.

The company reiterated that its total liquidity is now over $1 billion.

Last week, the company received a certificate from the U.S. Federal Aviation Administration to launch its pilot training academy to train personnel in preparation for its planned commercial air taxi services with its Midnight aircraft.

Archer forecasted first-quarter Adjusted EBITDA to be a loss of $95 million to $110 million.

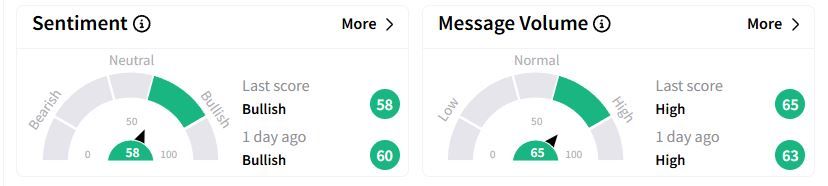

Retail sentiment on Stocktwits remained in the ‘bullish’ (58/100) territory while retail chatter remained ‘high.’

One user said that if investors are confident about the company's long-term vision, they should consider the after-hours move noise.

Another user attributed the stock move to ‘retail panic’ and said short sellers are taking advantage of it.

Over the past year, Archer Aviation stock has gained 66.7%.

Also See: Rocket Lab Stock Falls After Q1 Outlook Falls Below Expectations, Retail Optimism Undeterred

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)