Advertisement|Remove ads.

Archer Aviation Stock Falls On Short-Seller Allegations: Retail Bulls Hold Ground, Ask Jimmy Fallon To Accept Culper’s $1M Bet

Archer Aviation was down close to 1% in extended trading on Tuesday following a similar fall in the regular session after short-seller Culper Research accused the company of misleading investors.

“Over the past 12 months, Archer has systematically misled, deceived, or outright lied to investors about virtually every supposed milestone related to its development and testing of its eVTOL aircraft, Midnight,” the short seller said in a report.

Like its peer Joby Aviation, Archer is competing in the nascent electric vertical lift off and landing (eVTOL) industry. Many large cities worldwide are looking at eVTOL an alternative to road travel to reduce traffic congestion.

Culper said that Archer’s continued promotion of near-term commercialization is “not only premature, but reckless.”

The short seller criticized CEO Adam Goldstein’s appearance on The Tonight Show Starring Jimmy Fallon and Archer’s partnership with the Los Angeles Olympics.

Culper also alleged that while the company had claimed last week that it was ready to begin pilot-controlled flights with Midnight “within days,” the short seller said that “the aircraft was nowhere close to flying.”

The firm, which has previously shorted LendingTree and Soundhound AI, also said progress regarding the Federal Aviation Administration certification has stalled.

As expected following a short seller report, Archer would likely provide a detailed response to the allegations in the coming days.

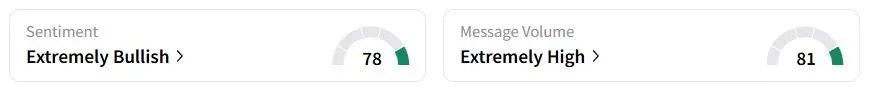

Yet, retail sentiment on Stocktwits was in the ‘extremely bullish’ (78/100) territory, while retail chatter was ‘extremely high.’

Culper also asked talk-show host Fallon to wager $1 million on an FAA-compliant commercial flight with him inside, a pilot, and three passengers before the end of the 2028 Olympics.

“This bet, if accepted, will make so many people in this thread millionaires,” one retail trader said.

“This went up too much too fast,” another user said.

The likes of Stellantis, United Airlines, and BlackRock are backing Archer. The company had more than $1 billion in cash and cash equivalents at the end of the first quarter.

Archer stock has gained 13.8% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Solana_722b6a3879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_X_Elon_Musk_274c6a8683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_o_leary_OG_jpg_2789641a97.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)