Advertisement|Remove ads.

AST SpaceMobile Stock Sinks After SpaceX Rival Prices $400M Convertible Note Offering: Retail Takes Cautious Stance

AST SpaceMobile, Inc. (ASTS) stock plunged in Thursday’s pre-market session after the Midland, Texas-based communication equipment company announced the pricing of a debt offering.

The company disclosed Wednesday after the close that it intends to sell $400 million aggregate principal of convertible notes due 2032 in a private offering to qualified institutional buyers.

Announcing the pricing of the offering on Thursday, the company said the convertible notes earmarked for the offering will carry a 4.25% interest rate, payable semiannually, and has an initial conversion price of $26.99 per share of its common stock.

AST SpaceMobile stock closed Wednesday’s session down 2.64% at $22.49. The conversion price marked a 20% premium to the price.

The company also said it has entered into capped call transactions regarding the pricing of the notes, which have an initial cap price of $44.98 per share.

AST SpaceMobile also granted initial purchasers of the notes an option to buy up to an additional $60 million aggregate amount of notes.

The company expects to raise net proceeds of $387.9 million from the offering. It plans to use $38.7 million of the net proceeds to pay the cost of the capped call transactions and the remaining for working capital or other general corporate purposes, including strategic transactions.

AST SpaceMobile operates in a capital-intensive industry as it builds a space-based cellular broadband network accessible directly by smartphones and can be used for both government and commercial applications.

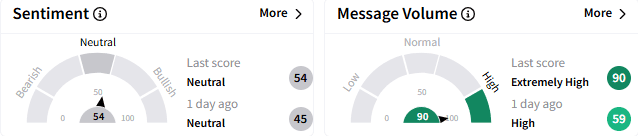

On Stocktwits, sentiment toward AST SpaceMobile stock stayed ‘neutral’ (54/100) but message volume perked up to ‘extremely high’ levels.

The stock was the top trending ticker on the platform early Thursday.

A stock watcher recommended patience as they see the stock doubling from current levels, citing the bright prospects for space stocks.

Another, however, was not so optimistic. They see the company slowly becoming extinct, given it competes with Elon Musk’s SpaceX.

In premarket trading, the stock fell 14.18% to $19.30 as of 7:01 a.m. ET. It is up about 6.6% so far in January after jumping about 250% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)