Advertisement|Remove ads.

Astera Labs Stock Slides As Strong Q4 Earnings Fail To Offset Cost Pressures, But Retail Sentiment Hits Year-High

Astera Labs Inc. (ALAB) fell nearly 5% in pre-market trading Tuesday, even after the company reported stronger-than-expected fourth-quarter earnings. While revenue surged on AI-driven demand, investors appeared cautious about ongoing profitability challenges.

The AI connectivity solutions provider posted earnings per share (EPS) of $0.37, beating an analyst estimate of $0.26.

Revenue reached $141.1 million, exceeding the consensus forecast of $127.9 million, according to Stocktwits data.

Fourth quarter revenue climbed 25% sequentially and soared 179% year-over-year, bringing full-year sales to $396 million—a 242% increase over 2023.

CEO Jitendra Mohan attributed the company's revenue surge to robust demand for its Aries PCIe Retimer products, with additional strength from Taurus Smart Cable Modules for Ethernet in the fourth quarter.

Mohan noted that while the company expects its Scorpio product line to become its largest revenue driver, its contribution in 2025 is projected to be just above 10%, leaving the timeline for broader adoption uncertain.

Despite strong top-line growth, profitability remains a concern.

Astera Labs reported a gross margin of 74.1% in Q4, a decline from the previous quarter due to a shift in product mix toward hardware-based solutions.

Operating expenses for the coming quarter are expected to range between $66 million and $67 million, driven by research and development expansion, employee merit increases, and acquisition-related costs.

"We expect 2025 to be a breakout year as we enter a new phase of growth," Mohan said. "Revenue from all four of our product families will support a diverse set of customers and platforms, including our flagship Scorpio Fabric products for PCIe connectivity and AI accelerator clustering."

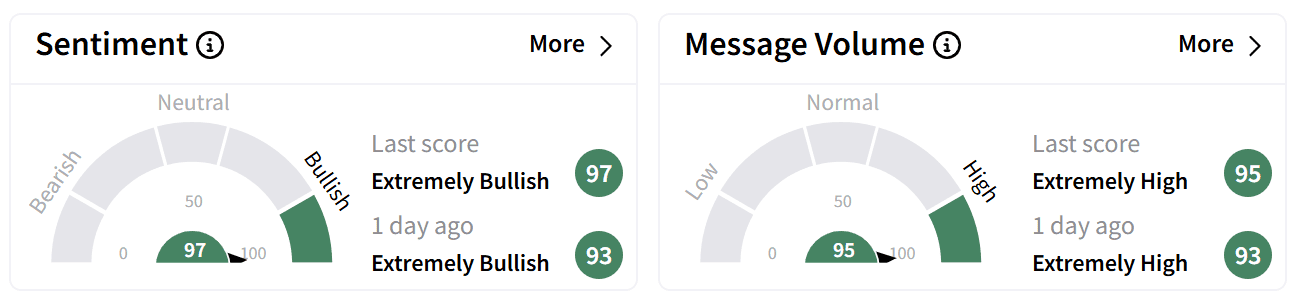

Despite the stock’s pre-market decline, retail sentiment on Stocktwits hit year-high levels in the ‘extremely bullish’ region, accompanied by ‘extremely high’ levels of chatter.

Some retail investors expressed frustration over the share price drop despite an earnings beat.

Wall Street analysts remain upbeat on Astera Labs' prospects, according to TheFly.

Deutsche Bank raised its price target to $120 from $100 while maintaining a "Buy" rating. Evercore ISI increased its target to $123 from $110, reiterating its "Outperform" rating.

Evercore ISI analysts noted that Astera Labs benefits from momentum across multiple product lines, with further upside potential as new offerings are introduced over the next 12 to 18 months.

The brokerage also stated that current earnings estimates for 2025 and 2026 may be conservative.

Astera Labs' stock has nearly doubled in the past year, gaining 96%, and are up 20% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)