Advertisement|Remove ads.

Atlanta Fed’s Raphael Bostic Reportedly Says It’s Unclear When The Next Rate Cut Will Happen

Atlanta Federal Reserve President Raphael Bostic reportedly said on Wednesday that it is unclear when the central bank can reduce interest rates again in the wake of uncertainty around the inflation trajectory and the scope of possible changes to tariffs and other policies from the Trump administration.

"It's going to take a while to just figure out what is going on," Bostic said in a presentation to business executives in Atlanta, according to a Reuters report.

Bostic said that the next rate cut will happen later than it would have otherwise. “It may be that the fog lifts quickly, or it may be that complexity increases, and the fog stays with us,” he said.

According to the Bureau of Labor Statistics, the consumer price index (CPI) rose 0.5% in January on a seasonally adjusted basis, while the annual inflation rate rose 3%.

According to a CNBC report, this compares with a Dow Jones estimate of 0.3% and 2.9%, respectively. Core CPI, which excludes food and energy prices, rose 0.4% in January and increased 3.3% annually, versus estimates for 0.3% and 3.1%.

Interestingly, Bank of America CEO Brian Moynihan has reportedly said the Federal Reserve is unlikely to cut rates this year as consumer spending remains strong.

“Our research team has taken all rate cuts off the table because they thought that the dynamics of the potential inflationary effect would cause the Fed to hold back,” he told CNBC.

With inflation coming in higher than expected, the Fed has solid reasons not to worry about rate cuts in the near term, dampening market optimism.

Traders had anticipated a 25 basis point cut in July 2025, but those expectations have now shifted to October 2025.

On Wednesday, Fed Chair Jerome Powell stated before the Senate Banking Committee that the central bank does not need to be in a hurry to cut interest rates and noted that while inflation has come down significantly, it is still above the 2% target.

The SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) fell nearly 1% in Wednesday’s pre-market but pared some losses.

Treasury yields rose, with the 10-year yield rising 10 basis points to 4.643%, while the two-year yield rose nine basis points to 4.386%, according to CNBC. The iShares 7-10 Year Treasury Bond ETF (IEF) traded 0.75% lower on Wednesday noon.

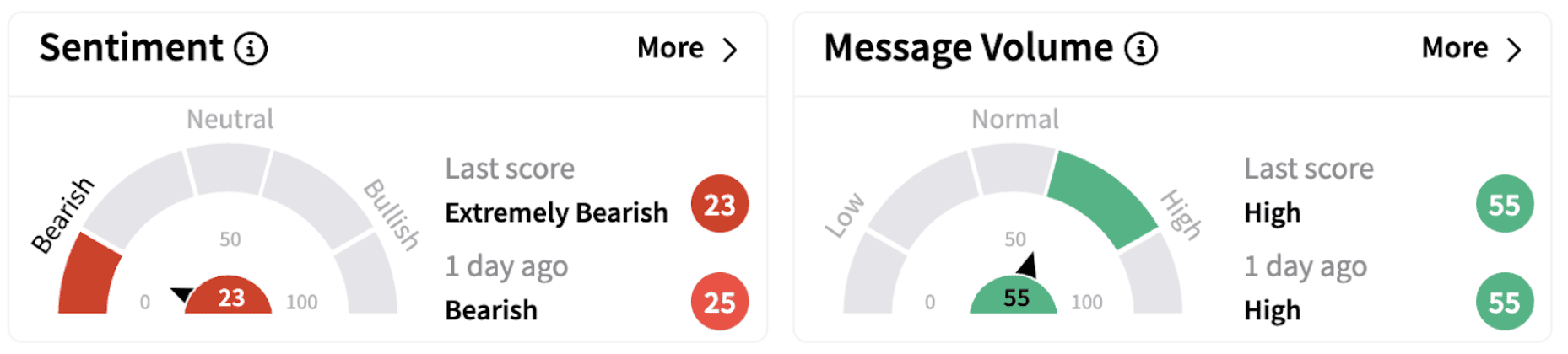

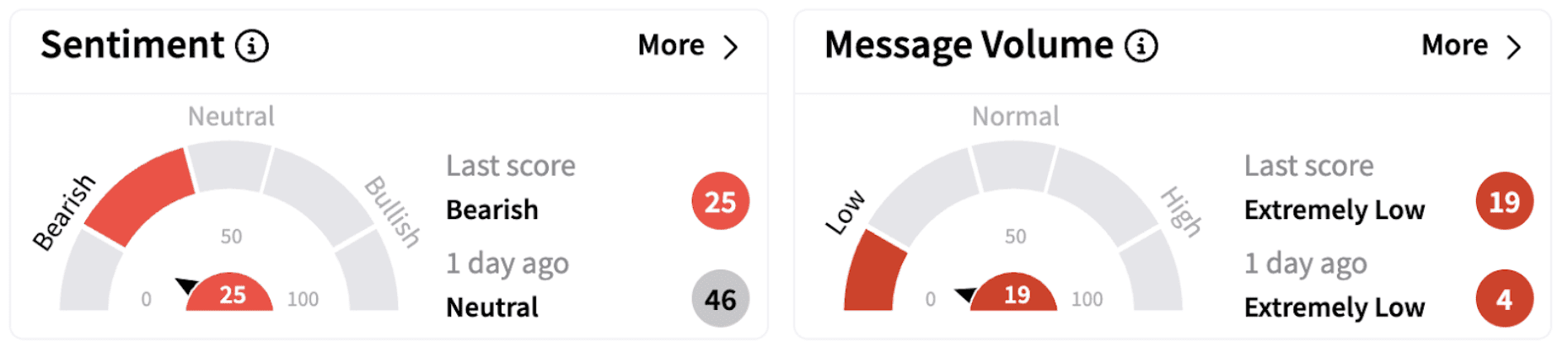

On Stocktwits, retail sentiment trended in the ‘bearish’ to ‘extremely bearish’ territories for these ETFs.

The SPY gained over 3% in 2025, while the IEF lost nearly 0.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)