Advertisement|Remove ads.

Atomera Craters Pre-Market On Q4 Miss, Set For Worst Day Ever – Retail Traders Rattled By Deal Delays

Atomera (ATOM) stock plunged more than 40% in pre-market trading Wednesday, setting the stage for its steepest single-day drop on record. The decline follows the semiconductor technology company’s mixed fourth-quarter (Q4) earnings and disappointing updates on future revenue prospects.

Atomera does not manufacture chips but develops and licenses its proprietary Mears Silicon Technology (MST) to semiconductor manufacturers.

If pre-market losses hold, the stock will fall to a three-month low and surpass its previous record one-day drop of 26.97% on Jan. 8, earlier this year.

Atomera reported a loss of $0.16 per share, slightly worse than analysts’ expectations of $0.14. However, the company surprised with $135,000 in revenue, outperforming estimates that had forecast no revenue for the quarter.

Despite the beat, revenue fell sharply from $555,000 in the same period a year ago, marking a significant year-over-year decline.

One positive note was Atomera’s cash position, which increased to $26.8 million as of Dec. 31, up from $19.5 million a year earlier. The company now has 30.1 million shares outstanding.

The stock tumbled after management disclosed setbacks in process qualification with semiconductor firm STMicroelectronics (STM) – potentially delaying Atomera’s path to production and revenue – in addition to a net loss of $18.4 million for 2024, indicating ongoing financial challenges.

Atomera’s CEO, Scott Bebo, said an initial six-month delay was due to logistics, but the collaboration remains on track. The process qualification phase is expected to take about nine months, though Bebo did not provide a clear timeline for when it would begin.

Further compounding concerns, negotiations with a “transformative customer” have stalled, further pushing out potential revenue opportunities.

Management indicated that despite strong interest in Atomera’s technology, clients continue to request additional data and validation before moving forward.

“Atomera is offering significant value, but negotiations involve multiple decision-makers and aren't solely about pricing,” Bebo said during the earnings call, emphasizing that the delays were not due to “technological issues.”

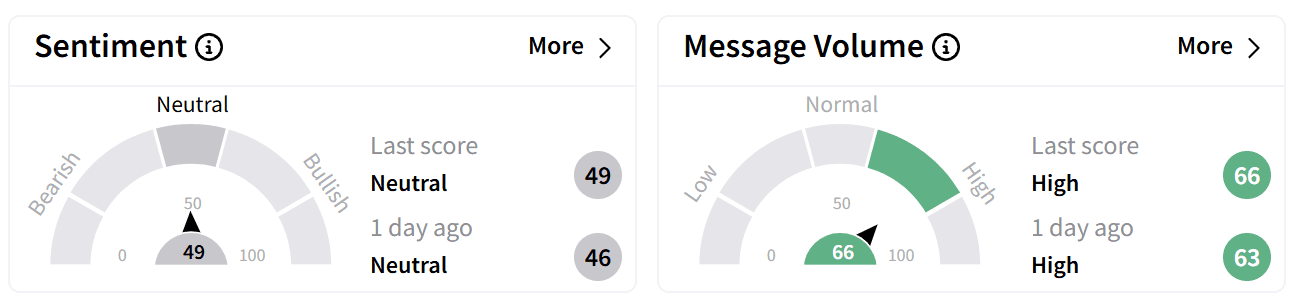

On Stocktwits, retail sentiment around Atomera remained ‘neutral’ accompanied by ‘high’ levels of chatter as investors on the platform decoded the company’s earnings.

Many expressed concerns over the company’s slow-moving client pipeline, with one investor noting that management commentary showcased that the company is back where it was 3-4 months ago .

Despite the setbacks, Bebo highlighted Atomera’s growing focus on the gallium nitride (GaN) market, which is projected to expand significantly in the coming years.

“GaN is a relatively new area for Atomera, with promising test results,” Bebo said. “We are awaiting further electrical characterization results, which could lead to faster market engagement and potentially quicker revenue generation compared to traditional business models.”

Atomera's stock was already down 26% in 2025 before today’s move. If pre-market losses hold, the company will have lost 66% of its market value year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: BNB Defies Crypto Market Decline Amid Binance-SEC Legal Time-Out But Retail Still Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)