Advertisement|Remove ads.

Autoliv Stock Rallies Pre-market On Upbeat Q1 Earnings: Retail’s Thrilled

Shares of Autoliv (ALV) traded 7% higher in Wednesday’s pre-market session after the company’s first-quarter (Q1) earnings surpassed Wall Street estimates.

Autoliv reported net sales of $2.58 billion, marking a dip of 1.4% from the corresponding period last year, but above an analyst estimate of $2.52 billion, as per FinChat data.

Adjusted earnings per share (EPS) stood at $2.15, marking an increase of 37% year-on-year, owing to cost reductions. The company’s reported EPS beat an analyst estimate of $1.67.

Autoliv produces safety systems such as airbags and seatbelts for car makers.

The company said that the U.S. tariffs and counter-tariffs in Q1 had a negligible impact on operating profit in the quarter as it managed to pass on the costs of tariff increases to car makers.

CEO Mikael Bratt said that car makers picked up sourcing safety products for future car models in the first quarter despite geopolitical uncertainty. He added that the company is looking forward to “significantly improved” sales performance in China in 2025 in light of new launches.

“Our navigation of the new tariff environment in the first quarter gives us confidence that it is possible to continue on that course when facing increasing or changing tariffs, although there is significant uncertainty,” he said. “We continue to closely monitor and evaluate the situation, focusing on being adaptive and agile, and we consider our regionalized footprint to be a valuable source for flexibility in a challenging geopolitical environment.”

Bratt warned that the current geopolitical and business environment uncertainties make it difficult to predict 2025, but said that the company looks forward to organic sales growth of 2% for 2025 and around 10-10.5% adjusted operating margin.

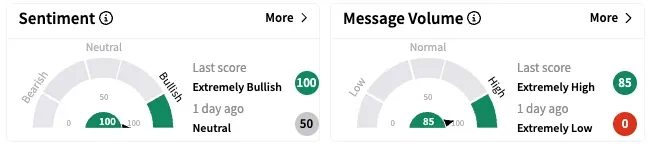

On Stocktwits, retail sentiment around Autoliv jumped from ‘neutral’ to ‘extremely bullish’ over the past 24 hours while message volume jumped from ‘extremely low’ to ‘extremely high’.

ALV stock is down by nearly 11% year-to-date and about 29% over the past 12 months.

Also See: DoorDash Retail Sentiment Drops After Successive Price Target Cuts

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)