Advertisement|Remove ads.

AutoZone Q3 Earnings Disappoint, CEO Says Margins Were Pressured: But Retail’s Optimistic

Shares of AutoZone, Inc. (AZO) were in the spotlight on Tuesday morning after the company’s quarterly earnings fell short of Wall Street expectations.

The automotive replacement parts and accessories retailer reported a 5.4% year-on-year (YoY) increase in net sales to $4.5 billion for its third quarter ended May 10, 2025, surpassing an analyst estimate of $4.41 billion, as per Finchat data.

The company’s same-store sales increased 3.2% during the quarter. This was driven by a 5% increase in domestic same-store sales, which offset a 9.2% decline in international same store sales owing to fluctuations in foreign exchange rates.

Diluted earnings per share came in at $35.36, down from $36.69 in the corresponding quarter of FY24, and below an analyst estimate of 37.15.

AutoZone opened 54 new stores in the U.S. in the quarter, 25 in Mexico, and five in Brazil for a total of 84 net new stores. As of May 10, 2025, the company had 6,537 stores in the U.S., 838 in Mexico, and 141 in Brazil for a total store count of 7,516.

CEO Phil Daniele said that currency rate moves continued to pressure sales and earnings in the quarter, but the company is focused on opening more stores in international markets.

“While our gross margins were pressured this quarter, we believe we will drive improvement as our new distribution centers ramp up and we continue to drive higher merchandise margins,” he said while adding that the company is “well prepared” for its summer selling season.

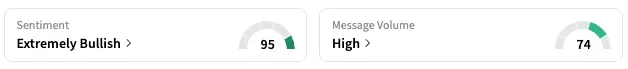

On Stocktwits, retail sentiment around AZO rose further within the ‘extremely bullish’ territory while message volume remained at ‘high’ levels.

AZO stock is up by about 14% this year and around 33% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)