Advertisement|Remove ads.

Axon Enterprises Stock Soars Aftermarket As Q4 Profit Tops Expectations, Retail’s Delighted

Axon Enterprises (AXON) stock jumped 13% after the bell as the TASER maker’s fourth-quarter profit topped Wall Street’s estimates.

Excluding items, the company reported net earnings of $2.08 per share for the quarter ended Dec. 31, while analysts, on average, expected it to post $1.40 per share in earnings.

Its net sales rose to $575.15 million from $430.38 million in the year-ago quarter, aided by double-digit growth in all its product segments. Wall Street was expecting it to post $566.04 million.

The company said revenue from its TASER segment, which produces the eponymous brand of electroshock devices, rose 37% to $221.2 million on robust demand for TASER 10 devices and associated cartridges and services.

The Scottsdale, Arizona-based company said that its Axon cloud and services revenue jumped 41% compared to last year to $230.3 million, helped by an increase in Axon Evidence's user count and expansion with existing customers adopting premium software offerings.

Axon Evidence is a cloud-based platform that enables law enforcement agencies to store and share critical evidence.

From the first quarter, it would transition from its existing reported segments to the new ones, Connected Devices and Software & Services.

The company, whose products are used in more than 85 countries, forecasted 2025 revenue in the range of $2.55 billion to $2.65 billion. Analysts, on average, expect the company to post $2.56 billion in revenue.

As of Dec. 31, its future contracted bookings rose 42% to $10.1 billion, compared to the previous year, driven by strong new contracted bookings in the second half of 2024.

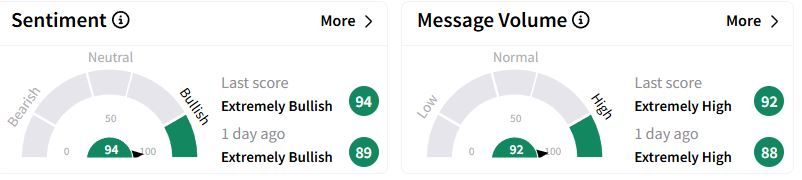

Retail sentiment on Stocktwits moved higher into the ‘extremely bullish’ (94/100) territory than a day ago, while retail chatter was ‘extremely high.’

One user hoped the stock would hit $650 by the end of the week.

Another user said that last week’s downgrades by multiple analysts created an opportunity to build a position in the stock.

Over the past year, Axon stock has gained 82.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)