Advertisement|Remove ads.

B2Gold Posts Surprise Loss Amid Rising Costs: Antelope Discovery Boosts Namibia Mine Outlook, Retail Turns Bullish

B2Gold Corp. (BTG) posted a surprise loss in the fourth quarter as its production costs surged due to a fall in output.

The Vancouver, Canada-based mining company missed both earnings and revenue estimates. On a year-on-year (YoY) basis, its revenue declined in Q4 and the fiscal year 2024, while rising costs dented its bottom line, resulting in a loss during the quarter.

Wall Street estimates pegged BTG’s revenue for Q4 at $501.82 million, but the company’s sales came in at $499.79 million. On a YoY basis, BTG’s revenue fell 2.4%.

For 2024, BTG’s revenue fell to $1.9 billion from $1.93 billion in 2023.

BTG reported a loss of $0.01 per share during Q4, compared to estimates of an earnings per share (EPS) of $0.06.

BTG reported that its production at the Fekola mine in Mali was hampered by a delay in accessing higher-grade ore. Further aggravating matters was damage to an excavator earlier in the year. The company faced availability issues throughout 2024, resulting in gold production falling below the lower end of its guidance.

BTG produced 392,946 ounces of gold from the Fekola mine, below its guidance of at least 420,000 ounces.

On a positive note for the company and its investors, BTG reported that a preliminary economic assessment of the Antelope mine could extend the life of its Namibia mine by five years.

Analysts at Bank of America (BofA) Securities raised their price target for the BTG stock to $2.85 from $2.75, implying an upside of over 7% from Wednesday’s close, according to The Fly.

That said, BofA cautioned about the possibility of capital expenditure inflation due to the extension of the Namibia mine’s life.

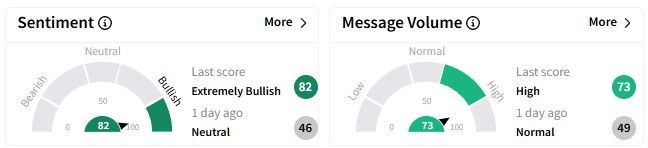

Retail sentiment on Stocktwits around the BTG stock soared, entering the ‘extremely bullish’ (82/100) territory from ‘neutral’ a day ago.

A similar surge in message volume levels was also observed.

BTG’s stock price has fallen more than 6% in the past six months. However, its one-year performance is relatively better, with gains of over 5.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)