Advertisement|Remove ads.

Baidu Stock Wins A Wall Street Upgrade Amid Hot Rally: Retail Investors Turn Cautious

DBS Bank raised its rating on Baidu's U.S.-listed shares to 'Buy' from 'Hold’ and set a price target $177 on Thursday, implying an over 30% upside from the last close.

Optimism surrounding Baidu's AI and cloud businesses, its emerging chip unit, and a planned 4.4 billion yuan ($56.2 million) offshore bond sale has lifted the stock to a two-year high.

DBS believes that Baidu is creating value from its emerging businesses, according to the investor note summary on The Fly. Baidu's robotaxi service, Apollo Go, recently secured a permit to test in Dubai. According to a Bloomberg report, the company is targeting Australia and Southeast Asia as its next markets.

Notably, several brokerages, including Arete Research, CFRA, and Nomura, raised their outlook on BIDU earlier this month. Ark Investment Management, run by noted tech investor Cathie Wood, bought over $13 million worth of shares in the Chinese search giant across two trades this week.

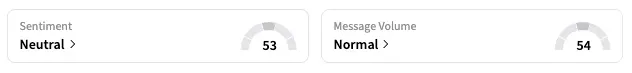

Baidu has drawn significant interest from retail investors on Stocktwits, as the stock climbed sharply (about 57% since its Aug. 20 low). Sentiment dropped to 'neutral' as of early Friday, from 'bullish' the previous day, which is usually typical after a strong rally.

Baidu and fellow tech giant Alibaba have surprised markets with sharp share gains on the back of their AI plans, drawing investors back to the Chinese tech sector. Alibaba had a 'bullish' retail sentiment as of the last reading.

BIDU shares are up 60.6% year-to-date, while BABA shares have risen over 110%. KraneShares CSI China Internet ETF (KWEB), which tracks Chinese tech stocks, is up 42.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)