Advertisement|Remove ads.

Baird Upgrades Urban Outfitters On Business Momentum: Retail Unimpressed

Baird upgraded its rating on Urban Outfitters (URBN) to 'Outperform' from 'Neutral' on Wednesday, following the apparel brand's investor day.

The investment firm said it is pleased with the company's growth strategy and highlighted its subscription-based clothing rental service, Nuuly, as a promising driver of future growth.

According to the investor note summary shared on The Fly, Baird raised its price target on the company's shares to $90 from $75. The latest target signals a 30% upside for the stock.

Baird said the stock could go up to $90-$100 in two years, supported by strong business fundamentals.

Last week, Jefferies upgraded its rating on the stock to "Hold" and said that all Urban Outfitters brands — Anthro, Free People, FP Movement, and Nuuly — continue to drive positive sales growth with "healthy trajectories" ahead.

The company's shares jumped 23% on May 22, a day after it released its quarterly earnings report, to a new all-time high.

Urban Outfitters reported Q1 revenue and profit above Wall Street expectations, and CEO Richard Hayne dismissed any signs of a slowdown in consumer demand.

The comments were reassuring, especially as several brands have reported an impact from U.S. tariffs and macroeconomic uncertainties.

American Eagle (AEO) withdrew its 2025 forecast, while Abercrombie & Fitch (ANF) forecasted up to 5% sales growth, compared to 16% last year.

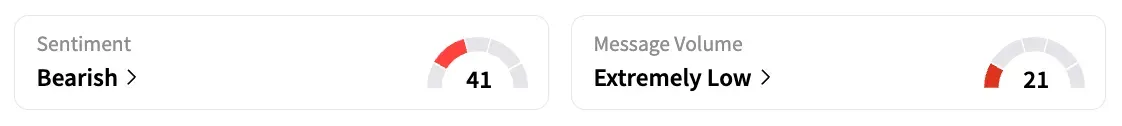

On Stocktwits, the retail sentiment for Urban Outfitters continued to be in the 'bearish' territory, unchanged for several months.

A user said the stock is “heading to 80."

URBN shares are up 26.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)