Advertisement|Remove ads.

Urban Outfitters CEO Boosts Stock, Retail Confidence On Seeing No Signs Of Demand Slowdown After Big Q1 Beat

Urban Outfitters (URBN) shares rallied 17% in extended trading on Wednesday after the apparel and accessories retailer reported first-quarter results above expectations and dismissed signs of a demand slowdown.

Revenue rose 10.7% to $1.33 billion, surpassing the $1.29 billion estimate from analysts surveyed by FactSet.

Adjusted profit was $1.16 per share, handily beating the estimate of $0.82.

"Despite the noise in the headlines and the broader economic uncertainty, our customers continued to show resilience," CEO Richard Hayne said. "We haven't seen any signs of a demand slowdown."

The company's report allays investor fears of an all-out slump in retail sales due to President Donald Trump's aggressive and shifting trade policy.

Several retail businesses have flagged a severe impact; this quarter, big box retailer Target (TGT) and fashion brand American Eagle (AEO) withdrew their forecasts, citing macroeconomic uncertainty and weak demand trends.

Rival Abercrombie & Fitch (ANF) forecast 2025 sales growth of 3%-5% in March, compared to 16% growth last year.

Urban Outfitters, which runs the namesake stores and Anthropologie and Free People chains, said that all its brands grew in the last quarter, which ended in April.

Same-store sales increased 7% at Anthropologie, 3% at Free People, and 2% at Urban Outfitters.

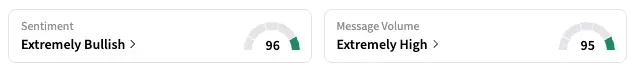

On Stocktwits, the retail sentiment for the company jumped to 'extremely bullish' from 'bullish,' and message volume was also 'extremely high.'

One user said the stock will hit another all-time high on Thursday.

Urban Outfitters' stock has gained over 15% intraday only twice in the last two years. Currently, it trades near an all-time high level.

Up to their last close, Urban Outfitters shares are up 8.6% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)