Advertisement|Remove ads.

Bank Of America Q1 Preview: Trump Tariffs Raise Risks To Earnings, Investors Eye Outlook

Bank of America (BAC) stock was in focus ahead of its first-quarter earnings report scheduled on Tuesday.

According to FinChat data, analysts expect the lender to post adjusted earnings of $0.82 per share on revenue of $26.91 billion. The company has topped market estimates in all four previous quarters.

Investors will keenly watch the bank’s earnings after peers JP Morgan and Wells Fargo warned of economic volatility due to tariffs imposed by President Donald Trump.

On April 2, Trump imposed reciprocal tariffs on several countries before enacting a 90-day pause on all countries except China. Last week, China was subjected to a 145% tariff after Beijing retaliated with its tariffs.

In his latest move, the U.S. President paused tariffs on some consumer electronics goods and semiconductors.

Investors would also pay attention to the bank’s commentary on investment banking. According to Dealogic data, dealmaking activity in the first two months of this year in the U.S. was the slowest in over two decades.

Morgan Stanley analysts noted last week that slower GDP growth with rising economic uncertainty would hinder the capital markets' rebound, incrementally slow loan growth, and drive net charge-offs across consumer and commercial loans slightly above the brokerage’s prior estimates.

JP Morgan boosted its provisions for credit losses in the first quarter to $3.3 billion from $1.9 billion a year earlier in anticipation of higher debt repayment failures.

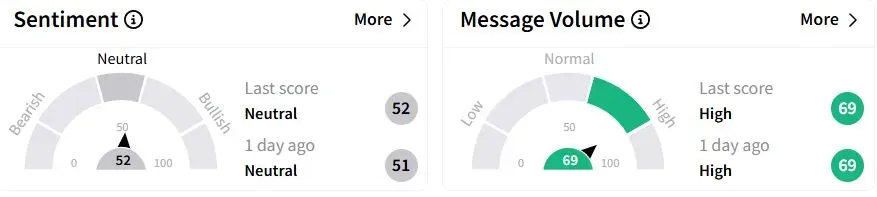

Retail sentiment over Bank of America on Stocktwits was in the ‘neutral’ (52/100) territory, while retail chatter remained ‘high.’

Bank of America shares have fallen 2.2% over the past year.

Also See: Bill Ackman Says China 'Asks' For Tariff Relief After Trump's 90-Day Pause: 'Rift Is Healing'

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)