Advertisement|Remove ads.

Barrick Offloads Its Last Canadian Gold Mine For $1.1B Amid Copper Push

Barrick Mining Corp (GOLD) said on Wednesday it has agreed to sell its Hemlo project, the company’s last gold mine in Canada, to Carcetti Capital in a deal that could reach up to $1.1 billion.

Initially, Barrick is expected to receive $875 million in cash after the deal’s closing, expected in the fourth quarter. The miner will also receive $50 million worth of shares in Carcetti, which will become Hemlo Mining following the combination, as well as a further $165 million related to production and gold price-based targets.

“The sale of Hemlo at an attractive valuation marks the close of Barrick’s long and successful chapter at the mine and underscores our disciplined focus on building value through our Tier One gold and copper portfolio,” said Barrick CEO Mark Bristow.

The Toronto-based miner is capitalizing on a surge in bullion prices, which have soared above $3,600 per ounce amid geopolitical uncertainty and expectations of a reduction in benchmark interest rates. Bristow noted that the Hemlo sale, alongside the divestiture of its stakes in the Donlin project in Alaska and Alturas mine in Chile, will help it net over $2 billion this year.

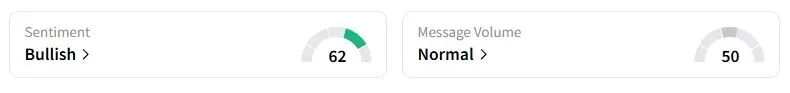

Retail sentiment on Stocktwits about Barrick was in the ‘bullish’ territory at the time of writing.

“Canada remains an important jurisdiction for Barrick, with a portfolio that includes a number of prospective early-stage projects and exploration targets,” Barrick said in a statement. “The company will continue to pursue opportunities to find and operate world-class gold and copper mines in Canada.”

Barrick is increasingly bolstering its copper output amid a surge in demand for the metal, which is seen as a key part of the energy transition. In a symbolic shift, the company renamed itself to Barrick Mining from Barrick Gold earlier this year.

In August, the company reported a 5% increase in second-quarter gold output and a 34% surge in copper production compared to the first quarter, supported by a strong contribution from its Lumwana project in Zambia.

Barrick’s stock has jumped 87% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)