Advertisement|Remove ads.

Baxter Stock Logs Worst Day In 3 Months On Margin Pain And Weak Guidance — Retail Sees Long-Term Buy Opportunity

- Baxter’s Q3 profit rose 41% year-over-year, but gross margin plunged 430 basis points to 39.4% amid higher manufacturing costs and weak IV solution demand.

- The company cut its 2025 EPS and sales forecasts and announced a dividend reduction starting January 2026 to accelerate debt repayment.

- Shipment delays for its Novum infusion pump and continued fluid conservation in U.S. hospitals are expected to weigh on near-term performance.

Shares of Baxter International Inc. fell sharply on Thursday, logging their worst session in three months, after the medical products company’s upbeat profit performance was outweighed by weaker margins, reduced guidance, and lingering operational challenges.

The stock plunged 14.5% to $19.16 on Thursday, before recovering 1.6% in after-hours trading.

Margins Sink Despite Strong Earnings

For the third quarter (Q3), Baxter reported $2.8 billion in sales, up 5% year-over-year, and an adjusted EPS of $0.69, a 41% increase from last year, marking its highest quarterly profit since 2022.

However, the improvement was driven primarily by one-time benefits including temporary service agreement (TSA) income and cost discipline, while underlying operational momentum remained sluggish.

The company’s gross margin plunged 430 basis points to 39.4%, hit by product mix shifts, lower IV solution volumes, and higher manufacturing costs. Operating margin also narrowed, forcing Baxter to cut full-year guidance for both revenue and earnings.

Infusion Pump Delays And Weak Hospital Demand

Sales from Infusion Therapies and Technologies (ITT) fell 4% operationally, due to ongoing shipment holds for the Novum IQ Large Volume Pump (LVP), an issue the company now expects to extend beyond 2025 because of unresolved flow rate problems.

Meanwhile, demand for IV solutions in U.S. hospitals remained soft as health systems continued fluid-conservation measures following Hurricane Helene, delaying recovery in one of Baxter’s core markets.

The company also cited tariff costs of about $40 million this year and supply chain inefficiencies from lower production volumes as additional drags on profitability.

Dividend Cut And Guidance Reduction

Baxter said it would slash its quarterly dividend to $0.01 per share starting January 2026, freeing up over $300 million in annual cash flow to pay down debt. It aims to bring net leverage down to 3x by the end of 2026, before resuming more aggressive capital deployment.

The company lowered its 2025 adjusted EPS outlook to $2.35–$2.40 (from $2.42–$2.52 previously) and trimmed its full-year sales growth target to 4%–5% reported, or just 1%–2% operationally.

Fourth-quarter guidance also disappointed, with EPS projected between $0.52 and $0.57, reflecting continued volume softness and margin pressure.

New CEO Faces Challenge Of Stabilizing Operations

Newly appointed CEO Andrew Hider said the focus is on stabilizing the business, strengthening the balance sheet, and embedding a “continuous improvement” culture through a new internal program called Baxter GPS (Growth and Performance System).

Hider acknowledged the near-term headwinds but maintained that the company’s diversified hospital product portfolio and cash flow discipline position it well for recovery.

Baxter Draws Wave Of Optimism On Stocktwits

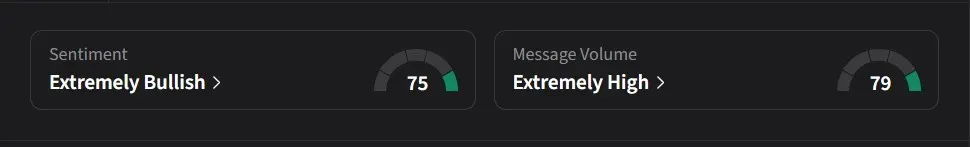

On Stocktwits, retail sentiment for Baxter was ‘extremely bullish’ amid a 2,100% surge in 24-hour message volume.

One user said they had started a position below $20 and saw it as an easy long-term hold.

Another user argued the stock was undervalued given Baxter’s long history and dominant role in U.S. healthcare, suggesting it remained a strong candidate for long-term gains.

Baxter’s stock has declined 33% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)