Advertisement|Remove ads.

Bayer Stock Fuels Hyper Bullish Retail Mood After Confirming New Stroke Study Met Key Goals Following 2023 Halt

- Bayer said its new Phase III stroke study of asundexian hit both primary efficacy and safety goals.

- The update comes two years after the company halted the OCEANIC-AF trial when interim data showed asundexian was inferior to Eliquis.

- The study enrolled more than 12,300 patients worldwide, and Bayer plans to engage with regulators as it prepares marketing submissions.

Retail traders turned hyper bullish on Sunday after Bayer AG confirmed that its Phase III stroke study of asundexian met its primary efficacy and safety endpoints, two years after the company halted its separate OCEANIC-AF trial in 2023.

Asundexian Reduces Ischemic Stroke Risk

Bayer said patients taking 50 mg of asundexian once a day alongside antiplatelet therapy saw a meaningful drop in ischemic stroke risk compared with those given a placebo and antiplatelet therapy. The company added that the treatment did not lead to higher rates of major bleeding. Bayer said this is the first late-stage study of a drug in the Factor Xla inhibitor class, which helps prevent clots from forming, to be successfully completed.

Large Global Phase III Study

Bayer said the trial was conducted across multiple countries and medical centers, using a randomized, placebo-controlled design. More than 12,300 patients took part, all of whom had recently experienced a non-cardioembolic ischemic stroke or a high-risk transient ischemic attack. The study tested whether adding asundexian to standard antiplatelet therapy could lower their chances of having another stroke.

High Burden Of Recurrent Strokes

The company noted the growing global need for better secondary stroke prevention. They said nearly 12 million people worldwide experience a stroke each year, and that 20%–30% are recurrent. One in five stroke survivors will have another stroke within five years, and recurrent ischemic strokes tend to be more disabling and carry a higher mortality risk.

Mike Sharma, MD, principal investigator of OCEANIC-STROKE, said the topline results indicate that asundexian may become a new treatment option for reducing recurrent stroke risk.

Regulatory Path

Bayer said it will now engage with health authorities globally as it prepares to submit marketing authorization applications. Asundexian has Fast Track Designation from the U.S. Food and Drug Administration for stroke prevention in patients after a non-cardioembolic ischemic stroke. Bayer said asundexian remains investigational and is not approved in any country.

Halt Of OCEANIC-AF After Inferiority To Eliquis

Asundexian drew attention in 2023 when Bayer halted its OCEANIC-AF Phase III trial. Interim findings showed the drug did not perform as well as Eliquis, made by Bristol-Myers Squibb and Pfizer, in preventing strokes in high-risk atrial fibrillation patients. Bayer said the safety profile matched earlier studies and noted that independent trial supervisors advised continuing the stroke-focused OCEANIC-STROKE study.

Bayer said asundexian is part of the factor XI inhibitor drug class, which has also drawn interest from Novartis working with Blackstone, and from Bristol-Myers Squibb working with Johnson & Johnson. The compound had been positioned as one of four new drug hopefuls Bayer said carried a combined peak sales potential of more than 12 billion euros. The program followed the company’s Xarelto blood thinner franchise, which is expected to lose protection from key European patents in 2026.

Stocktwits Mood Turns ‘Extremely Bullish’

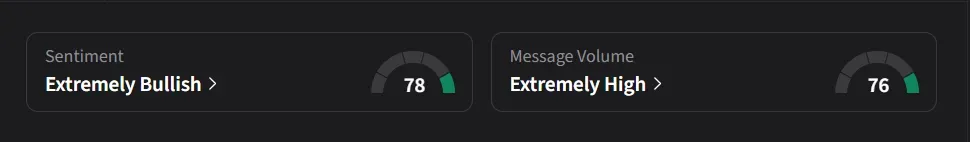

On Stocktwits, retail sentiment for Bayer was ‘extremely bullish’ amid ‘extremely high’ message volume.

Bayer’s U.S.-listed stock has risen 63% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)