Advertisement|Remove ads.

BBAI Stock Draws Retail Attention After Ask Sage Acquisition – Trader Calls It ‘The Stock Of 2026’

- The deal, which was finalized at the end of December, brings Ask Sage’s secure generative AI technology under the BigBear.ai umbrella.

- Ask Sage’s technology supports AI use cases where security and compliance are paramount.

- BigBear.ai stock gained over 4% in Friday’s premarket.

BigBear.ai Holdings Inc. (BBAI) is gaining significant attention on Friday as investors feel optimistic about the company’s acquisition of the secure AI platform Ask Sage.

On Wednesday, the AI solutions provider said it has closed a $250 million cash deal, expanding its footprint in mission-critical generative artificial intelligence across government and regulated sectors.

What Are Stocktwits Users Saying

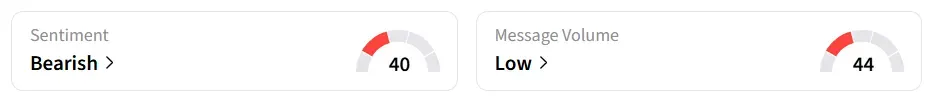

BigBear stock traded over 4% higher in Friday’s premarket and was the top-trending equity ticker on Stocktwits. However, retail sentiment around the stock remained in ‘extremely low’ territory, while message volume changed to ‘low’ from ‘normal’ levels in 24 hours.

A bullish Stocktwits user called BigBear.ai, ‘The Stock of 2026’.

Another user said 2026 will be ‘epic’ for the stock.

Another bullish user said that it wouldn’t be surprising to see some of them buying back shares this morning.

Acquisition Completed

The deal, which was finalized at the end of December, brings Ask Sage’s secure generative AI technology under the BigBear.ai umbrella, enhancing its ability to deliver trusted AI at scale to defense, intelligence, and other regulated environments.

Ask Sage’s technology supports AI use cases where security and compliance are paramount, and BigBear.ai expects that this expanded product set will deepen its engagement with agencies and enterprises that need AI systems capable of operating within governance frameworks.

BBAI stock has gained over 31% in the last 12 months.

Also See: Why Nio Stock Is Gaining Investor Attention Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)