Advertisement|Remove ads.

BEML Technicals Signal Strength: SEBI RA Deepak Pal Sees Room For Rally Till ₹5,000

BEML shares have entered a strong bullish rally, gaining notable momentum after July 3, noted SEBI-registered analyst Deepak Pal. The stock remains above its 14-day exponential moving average (EMA), indicating sustained buying interest and a bullish underlying trend.

The Parabolic SAR dots appear below the price, which typically represents an early sign of potential pullbacks. Despite that, the medium-term outlook remains positive, Pal said.

Momentum indicators are supporting the bullish strength. The relative strength index (RSI) remains well within the bullish zone, while the moving average convergence/divergence (MACD) has recently given a positive crossover, the analyst noted.

Although Monday’s broader market weakness prevented the stock from breaching its recent high of ₹4,651, BEML stock remains resilient. It opened at ₹4,550, touched a low of ₹4,532, and closed at ₹4,568.

From a trading perspective, any dip toward support can offer a good entry opportunity, with a suggested stop-loss at ₹4,400, Pal said.

If momentum continues, the stock has the potential to climb toward the ₹4,900 - ₹5,000 range in the near to medium term, representing a nearly 10% upside considering the upper end of the range.

Last week, the state-owned firm bagged two export orders worth $6.23 million for the supply of heavy-duty bulldozers to a CIS (Commonwealth of Independent States) nation and high-performance motor graders to Uzbekistan.

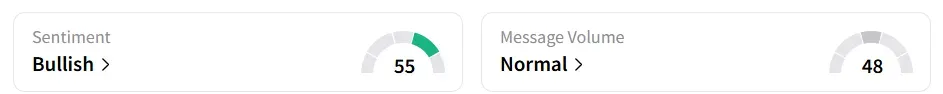

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a week earlier.

Year-to-date (YTD), the shares have risen 10.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)