Advertisement|Remove ads.

BETR Stock Rockets As Opendoor Bull Eric Jackson Hypes ‘Shopify of Mortgages’ And Predicts 350x Gains: Retail Goes All In

Hedge fund manager Eric Jackson, whose bullish commentary sparked an incredible rally in Opendoor Technologies shares, on Monday disclosed a position in housing finance company Better Home & Finance Holding, sending its shares rallying.

Better is the "Shopify of mortgages," Jackson said in an X post, adding that the stock is a "350-bagger in 2 years," implying it could rise to nearly $12,000 from its last closing price of $34.09. However, he did not disclose the size of his fund’s position on the stock.

Better shares surged as much as 173% before closing Monday up 46.6% — their best session in over two years. The momentum carried into extended trading, where the stock climbed 32%.

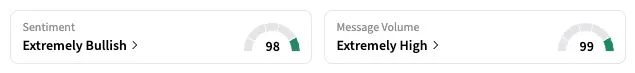

The developments caught the attention of retail traders. On Stocktwits, the 24-hour message volume for the ticker rose a whopping 3,250% and sentiment rose to nearly the highest possible level, 'extremely bullish' (98/100).

Interestingly, shares of Opendoor plummeted on Monday — 12.5% in the regular session and 5.7% in extended trading.

Jackson said his hedge fund, EMJ Capital, was long on BETR, citing the company's push to scale its lending business through artificial intelligence. He also said the firm is "growing faster than" blockchain-based credit company Figure Technology Solutions, which went public earlier this month, but trades at a significant discount based on forward sales expectations.

Better is a digital mortgage and home ownership platform that offers home loans, refinancing, and home equity products, among other home ownership-related services. It went public in August 2023 and had a market cap of just over $521 million as of Friday.

"$BETR I'LL GO WITH ERIC JACKSON ON THIS. TAKE THIS TO 100 +" a Stocktwits user posted, amid a flurry of comments debating whether to note the developments as market insights or pure hype.

"Eric Jackson formula: Find a low float stock, tell your followers on X it can go up 100-1000x (with no fundamental analysis as to why to support it). Immediately profit," another user remarked. "Where is the SEC?"

As of the last close, BETR stock has climbed 460% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Disney Stock In Spotlight As Jimmy Kimmel Returns To ABC After Charlie Kirk Backlash

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)