Advertisement|Remove ads.

BioAtla Stock Slips Premarket After Early Pop As Investors Weigh $40M SPV Deal For Phase 3 Cancer Trial

- The financing uses a single-asset SPV, allowing BioAtla to fund a pivotal study without a broader equity raise.

- BioAtla retains majority ownership of Oz-V, keeping 65% control across solid tumor indications after the transaction closes.

- Phase 3 enrollment is expected to begin in early 2026.

Shares of BioAtla Inc. (BCAB) slipped nearly 4% in premarket trading on Wednesday after early gains faded, as investors weighed the structure of the company’s $40 million special purpose vehicle (SPV) financing to advance its lead cancer program.

SPV Deal Funds Late-Stage Trial

BioAtla said the SPV transaction with GATC Health Corp. is designed to fund a registrational Phase 3 trial of ozuriftamab vedotin (Oz-V) in patients whose oropharyngeal cancer has progressed after prior treatments.

The company will receive an initial $5 million to support general operations and trial expenses, with the remaining $35 million expected to close in the first quarter of 2026 as the study begins.

Following completion, BioAtla will retain 65% ownership of Oz-V across all solid tumor indications, while the SPV, backed by Inversagen AI LLC, will hold the remaining 35%.

Investor Focus On Structure

The single-asset SPV approach allows BioAtla to fund a pivotal trial without a broader equity raise, but the structure appeared to draw a cautious response from investors after the initial premarket rally. Under the arrangement, the SPV will share in future development and commercialization economics for Oz-V.

Phase 3 Path

BioAtla will lead execution of the Phase 3 study, with patient enrollment expected to begin in early 2026.

The company said the trial is intended to support a potential accelerated approval pathway in the U.S. Oz-V has received Fast Track designation from the FDA for recurrent or metastatic squamous cell carcinoma of the head and neck.

BioAtla Retains Lead Role On Oz-V

The company said the financing provides a near-term path to advance Oz-V while preserving majority ownership, and noted ongoing discussions around expanding the drug’s use into other HPV-positive solid tumors, including cervical cancer.

BioAtla and GATC Health also expect to collaborate with Inversagen AI on additional research tied to senescence and longevity technologies, with BioAtla retaining rights for cancer applications.

How Did Stocktwits Users React?

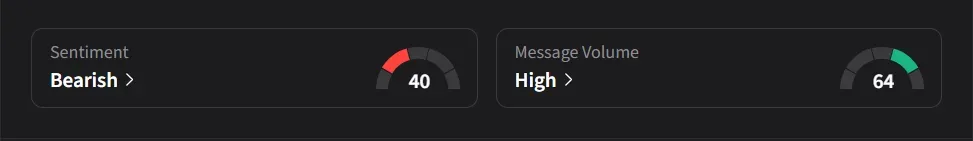

On Stocktwits, retail sentiment for BioAtla was ‘bearish’ amid ‘high’ message volume.

One user said the market had yet to fully price in the $40 million upfront component of the deal.

Another user said the deal fell short of a true global license agreement, pointing instead to the SPV structure and its terms.

BioAtla’s stock has risen 21% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)