Advertisement|Remove ads.

Biocon Stock Rebounds: SEBI RA Ketan Mittal Warns That Short-Term Headwinds Remain

Shares of Biocon were up 1.7% at ₹348.35 on Thursday, after falling 4.3% in the previous two sessions.

The pharma company is looking to raise ₹4,500 crore through a qualified institutional placement (QIP) at a floor price of ₹340.20 per share. It accounts for about an 11.6% stake.

Global brokerage firm HSBC trimmed its price target on Biocon to ₹390 from ₹400, while retaining its 'Buy' rating on the stock.

According to reports, HSBC noted that a successful QIP would help reduce Biocon’s debt burden but stressed that scaling up new biosimilars remains a key factor.

Biocon plans to raise funds to meet its financial obligations, including repaying optionally convertible debentures (OCDs) issued to Goldman Sachs AIF.

SEBI-registered analyst Ketan Mittal noted that while the QIP could be a long-term positive, short-term challenges persist, particularly the risk of potential tariffs on the pharma sector by U.S. President Donald Trump.

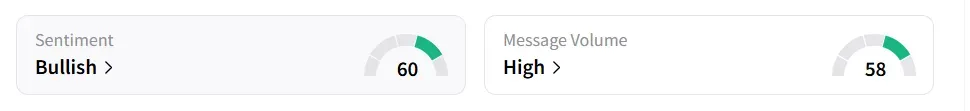

Retail sentiment on Stocktwits for Biocon’s shares turned ‘bullish’ from ‘bearish’ a week ago, amid high message volumes.

Year-to-date (YTD), the stock has shed 4.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)