Advertisement|Remove ads.

Crypto Majors Free Fall Despite FDIC’s Easing Stance on Banks As Trump’s ‘Tariff Pause’ Optimism Fades: Retail’s Losing Confidence

Cryptocurrencies retreated on Wednesday, giving up gains from the previous day that were fueled by President Donald Trump’s decision to pause trade tariffs on Canada and Mexico.

According to CoinGecko, the overall crypto market cap declined nearly 5% to $3.29 trillion in the last 24 hours.

The downturn comes even as the Federal Deposit Insurance Corporation (FDIC) signaled plans to revise bank guidelines, potentially allowing banks to engage in certain crypto activities without prior regulatory approval.

While banks have not been entirely barred from crypto, the proposed changes mark a significant departure from the Biden administration's restrictive stance, which had discouraged strong ties between traditional banking and digital assets.

The FDIC released 790 pages of correspondence related to banks’ requests to offer crypto services, revealing that such requests were often met with resistance, delays, and repeated demands for additional information.

“Looking forward, we are actively reevaluating our supervisory approach to crypto-related activities,” said FDIC Acting Chairman Travis Hill.

Despite these developments, cryptocurrencies pulled back amid broader economic uncertainty, with investors remaining cautious about regulatory shifts, inflationary pressures, and potential legislative changes.

Bitcoin (BTC) fell 3.5% to $96,800 in the past 24 hours, down 10.6% from its peak of $108,786 reached ahead of Trump’s inauguration on Jan. 20.

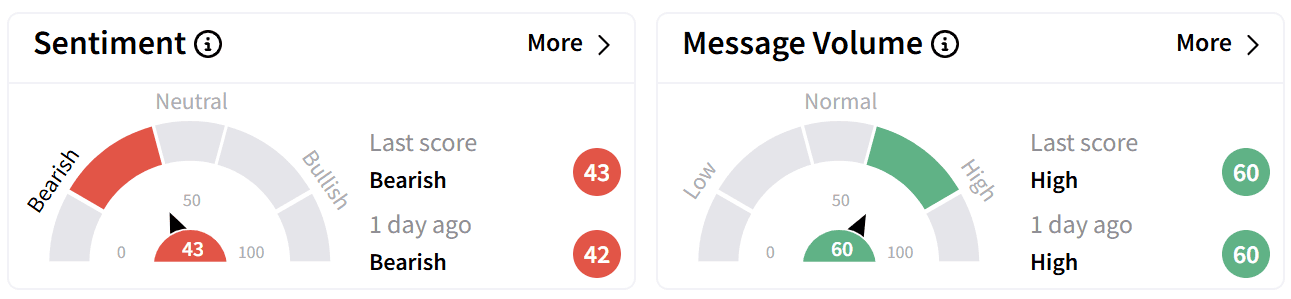

Retail sentiment on Stocktwits remained ‘bearish’, with ‘high’ levels of chatter reflecting disappointment that David Sacks, Trump’s appointed “Crypto Czar,” failed to generate bullish momentum despite a press conference outlining new digital asset legislation.

The conference focused primarily on stablecoins and provided a broad framework for future Congressional action.

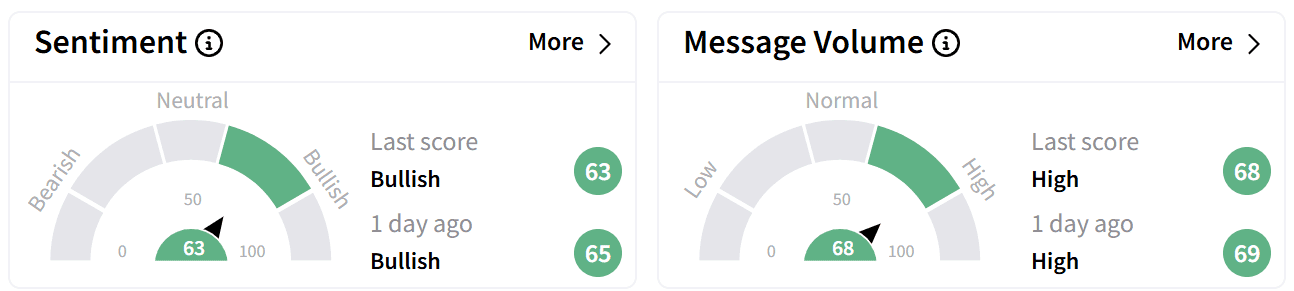

Ethereum (ETH) dropped 4.3% to $2,720 in the last 24 hours, though retail sentiment remained ‘bullish’ with ‘high’ levels of message volume on Stocktwits.

Some users expressed surprise that ETH didn’t rally on news of the FDIC’s revised crypto stance.

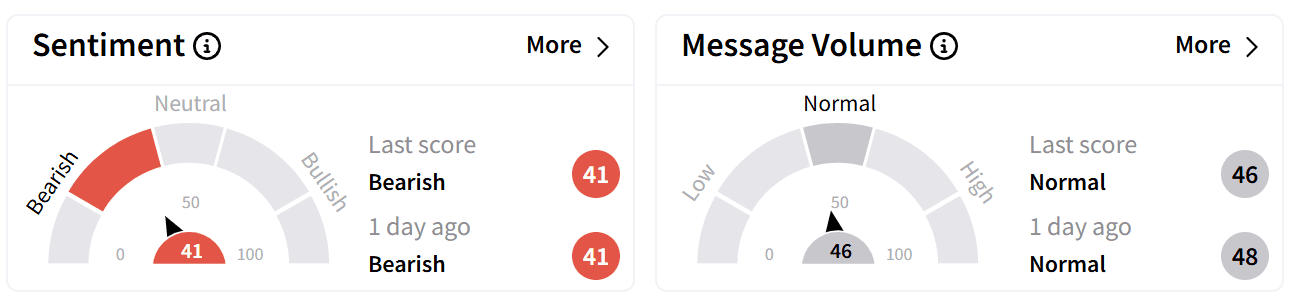

Ripple (XRP) saw a sharper decline, falling over 11% to $2.39 in the last 24 hours.

On Stocktwits, retail sentiment remained ‘bearish’ amid normal levels of chatter.

Users speculated that XRP's recovery would hinge on specific policy announcements favoring the token, while others expressed waning confidence.

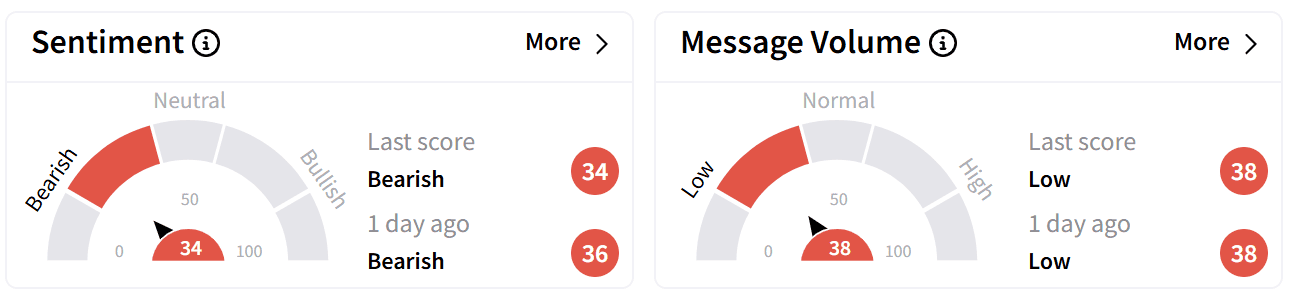

Solana (SOL) dropped 9% to $1.98 in the last 24 hours. On Stocktwits, retail sentiment remained ‘bearish’ amid ‘low’ levels of chatter.

Some users forecast continued declines this week with the potential for a weekend rebound.

The altcoin is currently trading 32.7% below its all-time high of $293.31, reached ahead of Trump’s inauguration.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)