Advertisement|Remove ads.

BlackRock Consortium To Acquire Majority Stake In Ports On Both Sides Of Panama Canal In $22.8B Deal: Retail’s Neutral

BlackRock Inc (BLK) shares drew investor attention on Tuesday after the company agreed to a $22.8 billion deal to acquire a majority stake in ports on both sides of the Panama Canal.

The deal comes amidst pressure from U.S. President Donald Trump to limit Chinese interests in the region.

According to a statement by CK Hutchison, the BlackRock-TiL Consortium will acquire Hutchison Port Holdings’ (HPH’s) 90% interests in Panama Ports Company (PPC), which owns and operates the ports of Balboa and Cristobal in Panama.

The BlackRock-TiL Consortium includes BlackRock, Global Infrastructure Partners, and Terminal Investment.

This transaction will proceed separately on confirmation by the Government of Panama of the proposed terms of the purchase and sale.

The consortium will also acquire CK Hutchison’s 80% effective and controlling interest in subsidiary and associated companies that own, operate, and develop 43 ports comprising 199 berths in 23 countries.

It also includes HPH’s management resources, operations, terminal operating systems, IT and other systems, and other assets related to the control and operations of those ports.

The aggregate Enterprise Value for 100% of HPH Ports Sale Perimeter, including the Panama Ports, has been agreed at $22.8 billion, it said. The PPC transaction definitive documentation is expected to be signed on or before April 2, 2025.

The canal bears significance in global trade flows and is important for U.S. trade as two-thirds of goods passing through the channel are moving into or out of the country, a CNBC report said.

BlackRock CEO Larry Fink said the agreement is a powerful illustration of BlackRock and GIP’s combined platform and its ability to deliver differentiated investments for clients.

“These world-class ports facilitate global growth. Through our deep connectivity to organizations like Hutchison and MSC/TIL and governments around the world, we are increasingly the first call for partners seeking patient, long-term capital. We are thrilled our clients can participate in this investment,” he said.

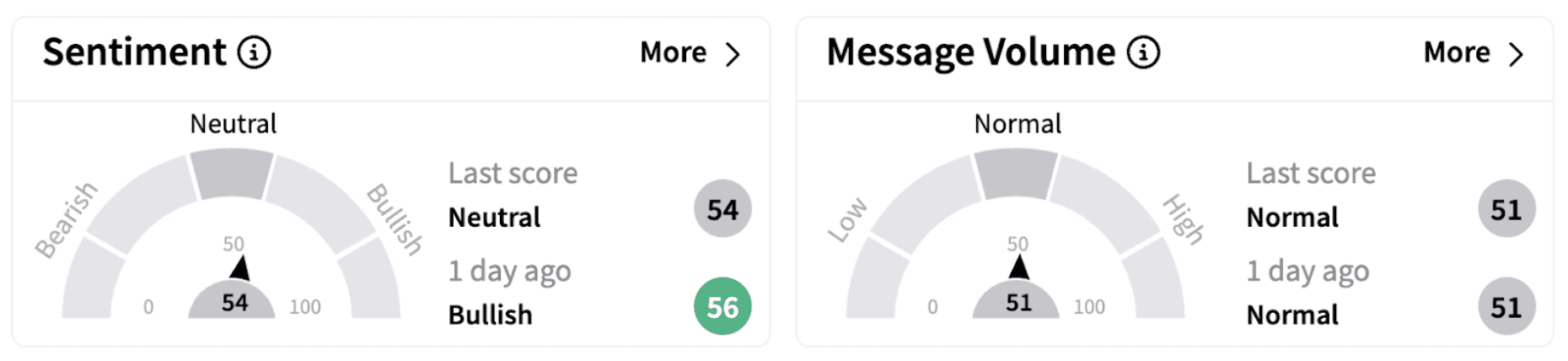

Meanwhile, on Stocktwits, retail sentiment dipped into the ‘neutral’ territory (54/100) from ‘bullish’ a day ago.

BlackRock's stock has lost over 6% in 2025 but has gained over 13% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)