Advertisement|Remove ads.

Blackstone Makes Strategic Minority Investment In ITE Management: Retail Stays Optimistic

Blackstone Inc (BX) announced on Thursday that funds managed by Blackstone Credit & Insurance (BXCI) made a strategic minority investment in asset manager ITE Management, L.P.

BXCI and ITE also launched a strategic forward-flow partnership. Under this, BXCI will target providing ITE with up to $2 billion of capital for investments and financing over the initial phase of the partnership.

BXCI’s Infrastructure and Asset-Based Credit platform provides investment-grade credit, non-investment-grade credit, and structured investments. It manages over $90 billion and has over 70 investment professionals.

ITE Management is an alternative investment firm focused on transportation infrastructure. It seeks to generate returns through a diversified portfolio of critical, income-generating transportation assets.

Blackstone said the transaction proceeds would be used to expand existing ITE products and fund growth initiatives, including new products and platforms.

Meanwhile, a Reuters report said on Wednesday that the Northumberland County Council has granted planning permission to Blackstone’s proposal for a $13 billion "hyperscale" data centre in North East England.

Earlier this week, Blackstone announced that it will acquire a majority stake in CMIC Co., Japan’s leading contract research organization.

CMIC provides comprehensive end-to-end services across clinical trial phases and therapeutic areas. While Blackstone will acquire a 60% stake, CMIC HOLDINGS will retain the remaining 40%.

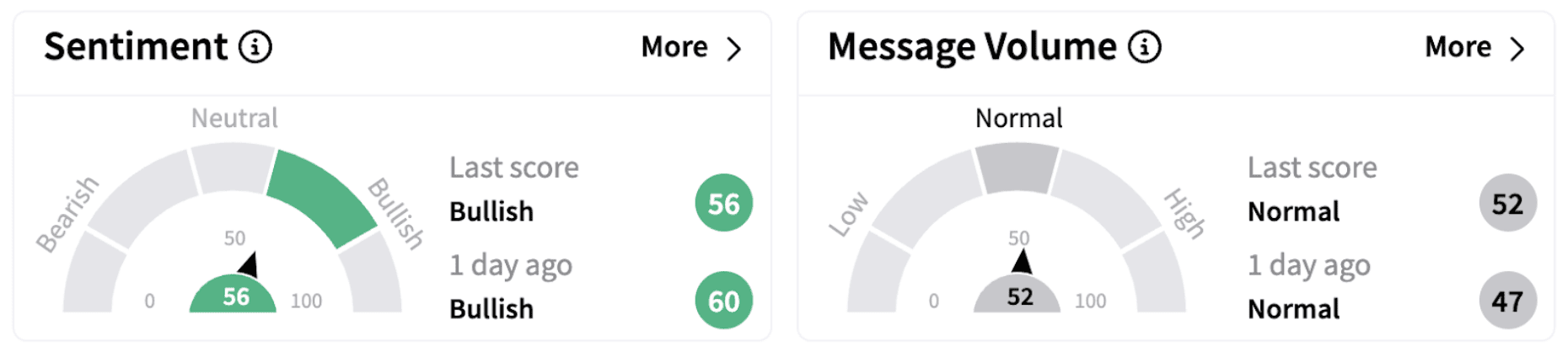

On Stocktwits, retail sentiment continued to trend in the ‘bullish’ territory (56/100), albeit with a lower score.

Blackstone also recently announced that funds managed by Blackstone Infrastructure will acquire Safe Harbor Marinas, a marina and superyacht servicing business in the U.S., for $5.65 billion.

Blackstone shares have lost over 13% in 2025 but are up over 20% in the past year.

Also See: Carrier Global Stock Surges On JPMorgan Upgrade: Retail’s Not Convinced Yet

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)