Advertisement|Remove ads.

Carrier Global Stock Surges On JPMorgan Upgrade: Retail’s Not Convinced Yet

Carrier Global Corp (CARR) shares rose over 4% on Wednesday after JPMorgan upgraded the stock to ‘Overweight’ from ‘Neutral’ while raising the price target to $78 from $77.

According to a CNBC report, JPMorgan analyst Stephen Tusa noted that the stock is trading below its HVAC (heating, ventilation, and air conditioning) peers and the sector. The analyst considers the stock the most attractive of the top three premium HVAC players on a relative basis.

“There is a high degree of uncertainty in HVAC, and we do not view the guidance as conservative, but it should be doable, which means the revision cycle is over, and valuation here is now at its relative lows and stands out versus peers who face similar uncertainty, but are trading at a premium,” the analyst said.

Tusa also noted that the stock is 25% off its 52-week high and is more attractively valued.

“In a sector that we view as not yet cheap enough to fully own, this one is cheap on a [sum of the parts] basis, reflective of a disconnect between the perception of fundamentals here versus peers, which should converge over time,” Tusa said, according to the report.

Meanwhile, Carrier Global said on Wednesday that the company is partnering with Google Cloud to enhance grid flexibility and support smarter energy management.

Led by the company’s new energy solutions business, Carrier Energy, the initiative will integrate Carrier's battery-enabled HVAC technology with Google Cloud's AI-powered analytics and WeatherNext AI models built by Google DeepMind and Google Research.

Last month, Carrier said its venture group, Carrier Ventures, will lead an investment and technology partnership with ZutaCore, an innovator of two-phase direct-to-chip liquid cooling technology for data centers.

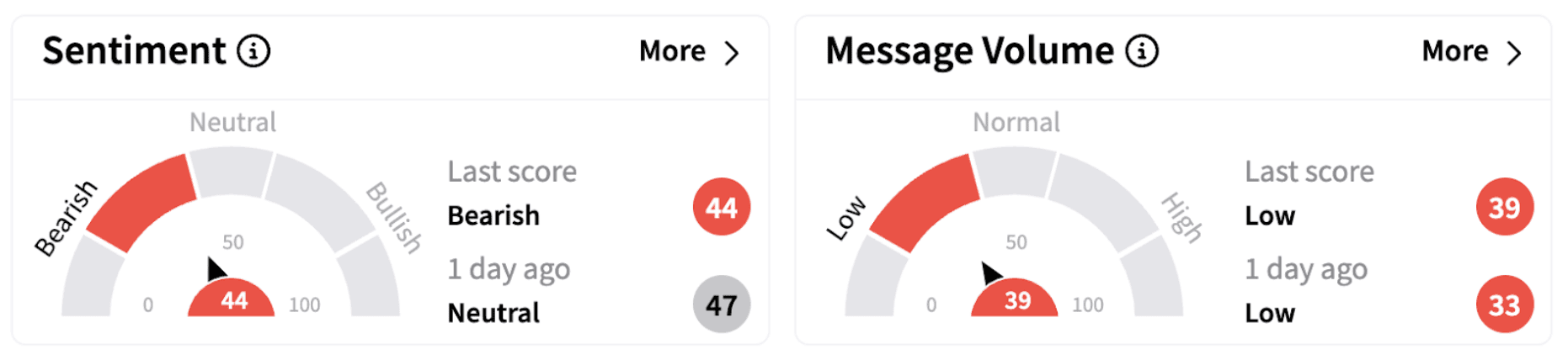

Meanwhile, on Stocktwits, retail sentiment dipped into the ‘bearish’ territory (44/100) from ‘neutral’ a day ago. The ticker witnessed a 400% rise in message volume over the past seven days on the platform.

Carrier Global stock lost over 5% in 2025 but has risen over 14% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)