Advertisement|Remove ads.

Blackstone Raises $8B For Latest Real Estate Debt Strategies Fund: Sentiment Improves But Investors Still In Wait-And-Watch Mode

The world’s largest asset manager, Blackstone Inc (BX), announced that it has raised $8 billion for its most recent real estate debt fund, Blackstone Real Estate Debt Strategies V.

According to a Reuters report, the fund will be active in North America, Europe, and Australia.

The announcement comes at a time when investors are searching for commercial real estate expecting a turnaround in this space as companies are increasingly demanding that employees work from office.

Blackstone said that the latest fund has flexible capital to invest around the world and is deploying capital across several strategies, including global scale lending, liquid securities, structured solutions to financial institutions, and corporate credit.

Tim Johnson, Global Head of Blackstone Real Estate Debt Strategies, expressed optimism about investors allocating the capital during the current period of market dislocation.

“We could not be more enthusiastic about the opportunities ahead, and with the support of the largest owner of commercial real estate as well as the largest alternative real estate credit platform in the world, BREDS V is well-positioned to deliver in this attractive vintage,” he said.

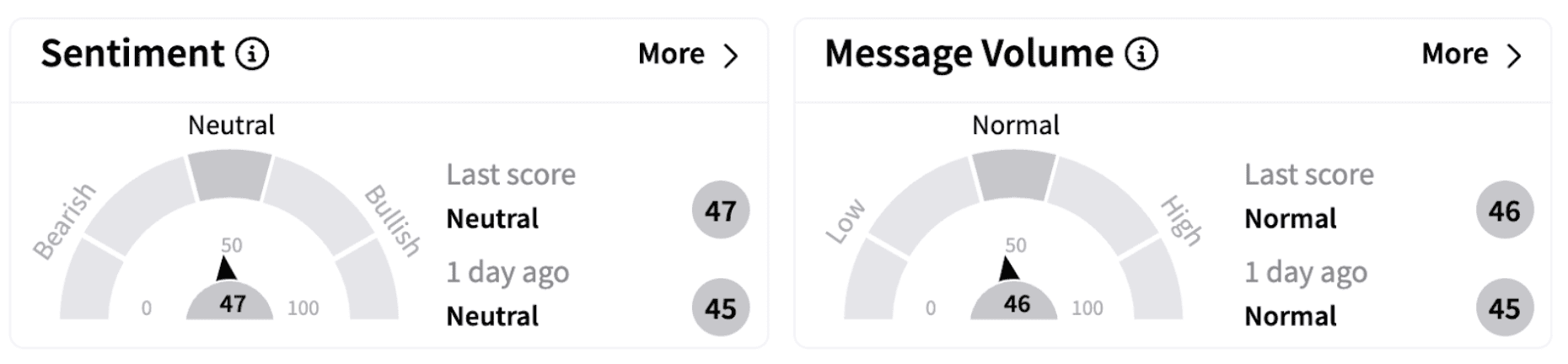

On Stocktwits, retail sentiment inched higher into the ‘neutral’ territory (47/100).

Recently, funds managed by Blackstone Credit & Insurance (BXCI) made a strategic minority investment in asset manager ITE Management, L.P.

BXCI and ITE also launched a strategic forward-flow partnership. Under this, BXCI will target providing ITE with up to $2 billion of capital for investments and financing over the initial phase of the partnership.

Blackstone shares have lost over 17% in 2025 but have gained over 14% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)